The Denver rental market is more than just healthy; it’s got a rosy glow. With vacancy rates low, prices for rental properties have risen and according to Poppy Harlow of CNN’s Early Start, Denver is one of the top five cities for rent increases, 10.9% over the past twelve months. That’s great news if you’re a landlord!

The Denver rental market is more than just healthy; it’s got a rosy glow. With vacancy rates low, prices for rental properties have risen and according to Poppy Harlow of CNN’s Early Start, Denver is one of the top five cities for rent increases, 10.9% over the past twelve months. That’s great news if you’re a landlord!

As the market fell and foreclosures soared, I have been focused on helping clients build wealth through investing in rental properties. Where are you going to move when you lose your home? A clean, safe, single-family home to rent where their lives and families can live and recover from the ordeal they’ve been through would be ideal. Many of these tenants would have had no problem paying their mortgages had they stayed at the pre-adjusted interest rates, or the troubles that befell them has passed. They are willing and able to pay good rent for a well-kept property that makes them feel back in balance. A recent survey on the rental market bears this out.

After surveying property managers, TransUnion found that increasing prices aren’t keeping tenants away. Overall, managers reported they are doing better than the year before and are having an easier time attracting in residents despite the increase in prices.

The credit bureau’s June survey included 1,248 property managers across the U.S. who represented a range of property sizes.

Read the Survey: Rental Market Attracting Residents Despite Price Increases. and let me know what you think.

There are some very attractive deals out there for those who want a good annual cash-on-cash return on their investment that owning real estate investment property provides, but the market is moving swiftly. I would recommend you do as well. “I don’t want to be a landlord” you say? I can help you with that through a few concise classes or introduce you to some affordable pros.

Well, look who’s coming back around. With all due respect for the “Respected Media”, it looks as if they finally got the memo. Though real estate, like the weather, is hyper-local the mainstream types reporting on the national outlook finally figured out that the housing market is growing again.

Well, look who’s coming back around. With all due respect for the “Respected Media”, it looks as if they finally got the memo. Though real estate, like the weather, is hyper-local the mainstream types reporting on the national outlook finally figured out that the housing market is growing again.

Both The Wall Street Journal and the New York Times said this week that “it would appear that housing is making a comeback”. Of course, REAL Trends has reported eight consecutive months of increased housing sales and three months of increasing housing prices, while NAR reports increased unit sales during the same time frame and that prices are firming.

Until Case Shiller said that prices were turning around, neither of these news organizations would report such a thing; perhaps that’s just as well. It took them 12 months to report that housing was headed downward. In fact, they still report the downturn as occurring in the spring/summer of 2006 when in reality the beginning of the slide was in fall 2005. That is when unit sales began to slump on an annual basis. Yes, I’m being picky…

The media may not always be fair or accurate in their reporting on the housing market. Recent years of staff cutbacks across the nation’s newspapers have left researchers and reporters without the time or (perhaps the inclination) to really research any sources that don’t fit their preconceptions.

Overreliance on Case Shiller tend to mask a real turnaround in most housing markets. Thanks to consumers and investors alike, housing is starting the long road back to health. Those of us “on the ground” have witnessed six months of solid grown in the Denver housing market, with homes selling quickly at or above asking price.

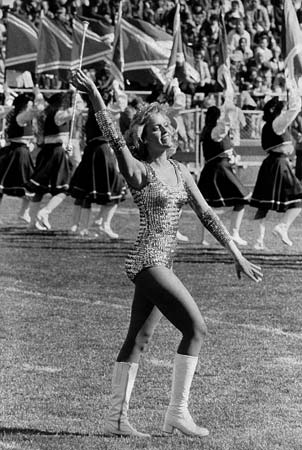

Though I’m not ready to start the parade (my calves are still sore from today’s Independence festivities) or predict a huge breakout of double digit appreciation, the evidence is overwhelming that housing is on the way back. Could it be time to strike up the band?

I grew up in a Dream House; a California Contemporary, resting in the shadow of a graceful Fredrick L Roehrig home, built for publisher Andrew McNally in 1893. This home gave birth to the future Spanish Colonial Revivalist master, Wallace Neff, and was his childhood home. You can see from the picture where he took his inspiration. My home inspired me as well as I trace time, I see its watermark upon my life. Maybe it was the land, a Spanish grant called Rancho Los Coyote, or the publisher who purchased it and planted the 500 acres of olive trees, or the proximity to Disneyland that made me who I am today; writer/ dreamer/Realtor. It all begins at home.

Long summer days were spent in the ‘cement pond’ or playing Barbies on the warm deck coping. Is it any wonder I love Spanish Colonial Revival architecture, David Hockney and Dream House Acres? Check the vid and you’ll see what I mean. xoxo

Are you a first-time homebuyer but missed that big tax credit? Are you tired of paying rent or is your rent being raised to astronomical limits? So let me ask you this… If you thought you could get a good deal and a $2000 tax credit, would you like to own a house in Denver? Good news.

Are you a first-time homebuyer but missed that big tax credit? Are you tired of paying rent or is your rent being raised to astronomical limits? So let me ask you this… If you thought you could get a good deal and a $2000 tax credit, would you like to own a house in Denver? Good news.

The City and County of Denver announced a new Mortgage Credit Certificate program that enables qualified borrowers to receive an annual federal income tax credit equal to 30 percent of the yearly interest paid on their mortgage loan, up to $2,000 annually, the city announced Tuesday.

“For many families, home ownership is a primary method of asset building and saving for the future,” says Denver Mayor Michael Hancock. “We’re providing a financial boost to individuals and families while increasing home ownership opportunities and the overall strength and vitality of Denver neighborhoods.” Lenders can use the estimated amount of the credit on a monthly basis as additional income to help a potential borrower qualify for a loan, the city said.

There are stipulations to the program. To qualify, borrowers must purchase a residence in the City and County of Denver and income restrictions apply ($79,300 for one or two persons and $91,195 for three or more). The maximum allowable purchase price for a home is $370,252, although higher income and purchase price limits are available in targeted areas. Participants cannot have owned a home in the past three years, except in targeted areas and for qualifying veterans.

Only certain lenders are approved to participate in Denver’s Mortgage Credit Certificate program and Paul Orrell at Megastar Financial, one of my favorites, is among them. Click here if you’d like more information about the Denver Mortgage Credit Certificate program, then shoot me an email. I’d be glad to go over your options.

One of Denver’s architectural wonders is the Fredrick C Hamilton Building, designed by Daniel Libeskind at the Denver Art Museum.. With its jutting roof line and walls all akimbo, I love its mix of elegance and surprise. Apparently the Fondation Pierre Bergé-Yves Saint Laurent did too because when DAM Director, Christoph Heinrich, approached them to host the Yves Saint Laurent Retrospective they said “Oui”. They make for a chic ensemble and quite the coup. Denver is the only stop in North America before this exquisite exhibit heads south of the border. New York must be green with envy.

One of Denver’s architectural wonders is the Fredrick C Hamilton Building, designed by Daniel Libeskind at the Denver Art Museum.. With its jutting roof line and walls all akimbo, I love its mix of elegance and surprise. Apparently the Fondation Pierre Bergé-Yves Saint Laurent did too because when DAM Director, Christoph Heinrich, approached them to host the Yves Saint Laurent Retrospective they said “Oui”. They make for a chic ensemble and quite the coup. Denver is the only stop in North America before this exquisite exhibit heads south of the border. New York must be green with envy.

When Yves Saint Laurent took his seam ripper to the nipped Dior waistline, he unleashed the power of the modern woman and seems to have designed her wardrobe for the past 50 years. The words ‘jumpsuit, pantsuit, safari look and bolero jacket’ were rarely heard before the genius of the YSL moment, and never to describe fashion. Influenced by global culture, Saint Laurent drew his inspiration from the arts and artists, from operas, literary figures, personal muses and “aesthetic ghosts;” he has woven time into the timeless.

Read more.

The Yves Saint Laurent Retrospective lands in Denver for an exclusive look into the designer’s genius. The Denver Art Museum is the only North American stop as this exquisite exhibit travels from Paris to South America. Why? “Because I asked.” says DAM Director, Christoph Heinrich. With the integration of local fashion stars and designers included in the gift shop and gallery, I say “Magnifique!”

I live and work in a city that fosters and grows its arts and cultural community, lights the way with a beacon of alternative energy investment, and preserves the character of the city’s neighborhoods and Technicolor past… That’s something to look up to.

Saying The Denver real estate market is hot is like saying that the U.S Congress works together in perfect harmony…except, the first statement is true. It will take a while before Denver home buyers believe it, but it is a Seller’s market…and a buyer’s market, too. Huh?

It sounds like a paradox but in fact it perfectly describes our current Denver Metro real estate market. Here’s how:

In the market below $300k where 80% of the homes are sold it’s a blistering seller’s market. You heard it right, a seller’s market! There are only three months of inventory sitting on the market right now, where six months is considered a normal, balanced market. There are simply more buyers than sellers right now and this is translating into multiple offers on listings, sales prices often well above asking prices, and marketing times plummeting.

Particularly hot is the market below $225k, which has only two months of inventory. It’s not uncommon for a listing to have 10 showings and a full price offer in the first week. There are a number of factors that have caused this dynamic, one of which is the dramatic reduction in the number of bank-owned and short sale properties on the market. This reduction in distressed inventory has left regular home sellers in a great position and contributed to the sizzling seller’s market.

Ok, so we know it’s a seller’s market. Then, how can it also be a fantastic buyer’s market at the same time? It is, because according to the National Association of Realtors the Home Affordability Index is at its highest recording ever. Just like it sounds, the HAI is a measure of how affordable homes are in a given area. It’s calculated by comparing the median price of a home in the Metro Denver market to the median worker’s income level, taking into account the current interest rate for a 30-year fixed rate loan. What this means is that the median income earner can buy more house today than ever before. Why? Because home prices, while rising quickly, are still well below their peak prices of 5-6 years ago and interest rates are at never-before-seen historic lows. Take it all together and the average home on the market HAS NEVER BEEN MORE AFFORDABLE.

So, while it seems like a paradox that it can be both a great time to sell and a great time to buy, it’s actually quite true. Call me and I’d be happy to explain more how we got to this state in the market and how you can take advantage of it.

Denver Metro Housing Stats.

Single Family:

Active Listings: 8,082 • Down 40% from Feb. ‘11

Under Contracts: 3,329 • Up 13% from Feb. ‘11

Solds: 1,978 • Up 12% from Feb. ‘11

Average Price: $270,821 • Up 2% from Feb. ‘11

Average Days on Market: 106 • Down 14% from Feb. ‘11

Condos:

Active Listings: 2,004 • Down 49% from Feb. ‘11

Under Contracts: 821 • Up 11% from Feb. ‘11

Solds: 517 • Up 13% from Feb. ‘11

Average Price: $161,143 • Up 4% from Feb. ‘11

Average Days on Market: 101 • Down 22% from Feb. ‘11

…with all due respect to the Staples Singers

…with all due respect to the Staples Singers

You’ve found the perfect house! Redone tip-to-toe! That kitchen with the gleaming stainless and the leathered granite is perfect, the master suite, divine, and the water feature will provide a soothing soundtrack for starlit summer nights on the back patio. It’s your dream house… until you see the Inspection Report.

Part “honey-do” list, part diagnosis, a home inspection is the best way to make sure your dream house isn’t a nightmare with a fresh coat of paint. No one wants to shell out $300-$600 to have someone crawl up in the attic and scope your sewer line, but believe me it may be the best money you spend in your home-buying (or selling) process. Last week, I thought for sure we’d fall out of contract once I delivered the Inspection Objection—it was the BIG LIST, and it had to be done by the seller if my buyer was going to go through with the purchase.

1. New roof

2. Sewer line offset repaired

3. Radon mitigation system installed

4. Electrical work on aluminum wiring

5. We overlooked the aging water heater.

So… now you know. What’s next? She had beaten the competing offers so she was paying a fair price, market value, certainly no bargain. With little room for $15-20k worth of repairs, especially on items which are considered “health and safety” issues, which can hold up the loan if left unattended, the buyer has some decisions to make. And I have some questions to ask, the one that tops the list…

Whose problem is it?

Thinking we might be at risk of losing the house, I sat with my client over coffee and asked her how she felt about all of this.

1. Do you love this house enough to stay in the deal?

2. Are you willing to do the work yourself?

3. What on this list is most important to you?

We worked our way through her options, she made her decisions, and I sent over the “final four” on our list of objections to the listing agent. “Do you think they’ll go for it?” my buyer asked, uncertain. “We know what you want, all we can do is ask“ (And I love the ask).

If a seller is motivated, your requests are not unreasonable, and the agents are good at what they do, chances are you can find a solution that suits all. In our case, that’s just what happened, but it ain’t always the case. So… how do you avoid the less harmonious outcome to this situation?

Sellers usually have a pretty good idea about what is wrong with their homes. The problem is they are used to living with that squeak in the floor, the drip in the downstairs bathroom and that little flicker in the dining room light fixture when the kids are on the computer. Many times, they’ll spend time and money preparing to put their house on the market, only to find a slew of hidden problems upon the Buyer’s inspection and a bucket of resentment along with them. It might be a good idea to have a home inspection BEFORE you list your property; that way, you’re able to make pre-market repairs or price accordingly if you choose not to. Buyers write offers based upon their emotional response to a home, but they walk away from contracts based upon practical matters. Chances are, they’ll feel better about a coat of paint or buying a new refrigerator than installing a radon system or a sewer repair. For Sellers, it’s “Be Prepared” and for Buyers “Beware”. In either case you will forget about the $300 check soon enough, but there will be that night at 2 a.m. when you’ll remember the mold report and wonder if it’s growing in your drywall… and if your buyer’s going to find it.

It took Dr. Richard Alpert, Timothy Leary and countless hits of LSD to learn one simple truth: Be Here Now. So what can the psychologist-turned-spiritual guru, Baba Ram Dass, teach you about today’s Denver real estate market? BUY. HERE. NOW.

With nary a trace of mind-altering substance in sight, I can honestly tell you that the time to list your home for sale in the Denver metro area is NOW.

“How now” you say?

• Because EVERYONE else IS WAITING until spring.

• Because buyers ARE out looking.

• Because SHOWINGS ARE UP and inventory is down.

• Because all FOUR OFFERS I wrote in January created a BIDDING WAR.

Now, we all know war is not the answer but in real estate, a competitive market results in sellers driving their purchase price above their asking price. At this point (Jan/Feb, so I’m being here this quarter) the demand exceeds supply and buyers are flying out to snatch up well-priced properties like savvy shoppers after Christmas at Filene’s Basement. There is simply not enough out there. And I’m not just talking of the under-$200-first-time-buyer/investor end of the market. A home priced at or around $300k is likely to move well, despite the common seasonal perception, the Super Bowl or the weather. On Friday, as constant snow flurries were rapidly accumulating inches, agents were rushing out to show homes in order to present their offer s before the “Highest & Best” deadline. (I know this, I was one of them.) Today I submitted an offer for a buyer on a property, sight unseen. The home fit his criterion and he’d been beaten out three other times, so today we take no prisoners.

If you are sitting on the sidelines, waiting for the winter storm to pass before you list your house, remember… you could be pushing up daisies before the crocus pushes through the frosty ground. Now, I don’t mean that in the literal sense of the metaphor, but in the BE HERE NOW spirit.

If you’d like more information on the value of your house, trends in your neighborhood, or a yoga class near you, send me a vibe, a text or find me on Facebook. As the guru said…“We’re all just walking each other home.”

― Ram Dass

It was headline news when Chaplin’s first “talkie”, “The Great Dictator”, premiered in October of 1940, and it seems the Tramp had a lot to say. I am a life-long film fan and being raised on the backlot of a Hollywood studio, I guess it’s only natural. I grew up watching movies and watching them being made. My father worked at M-G-M, our family friend ran the film library. I spent hours looking thorough old clips and screen tests (including my mother’s), viewing them as the celluloid was hand cranked through a Movieola or pressed into service by a warm projector. I’ve tried to give my sons some cinematic context for their lives, and despite the “Is this another old move, Mom?” protests, they are always happy we spent the time together when the final credits roll. I’ve seen them light up when they understand a reference to “Vertigo, grab a light pole and attempt a graceful swing around it, Gene Kelly style. They have the dubious honor of knowing all the words to “Shipoopi”, although Gabe insists it’s ‘Grab her buns when she isn’t lookin’. Chaplin, Keaton, Hitchcock, Wilder, Capra, Lumet and so many others; they have been the profits of my life. Sir Charles delivers a heartfelt and timely message here in the final speech of “The Great Dictator”. Enjoy.

Wondering what you can do to “be the change”? Here’s a video with an easy (and fun) way you can make your voice heard without camping out in the snow to the beating of drums. There are so many stories in America, each a unique experience within a collective experience. Whether you feel the Occupy Wall Street movement is an important expression of our frustration or a bunch of dirty-little-trust-fund-hippies, it has opened up a conversation about how we’d like to craft our future and that of our children. We’re in a moment of major change and there are many, many changes that need to happen; left, right and center. The first step is to create a dialogue, in this case with the banks who control our economy, our politics, and our destinies.

Let’s face it, we do want our lifestyle: we want our Starbucks and our comforts, and me, I like to see the ocean on occasion. We also want to stay in our homes and pay our mortgages, we want to feel our jobs are not going to be outsourced, we want our neighbors to have their jobs and their homes and we all want our freedoms. Here is a brilliant way to ensure those freedoms, including our First Amendment right to speak.

So we take responsibility. For our credit card debt, for our ability to create, and for being the change. Click here to see what you can do. Keep Wall Street Occupied. Oh… and there is sweet revenge for all that junk mail ; )