The facts about selling your home For Sale by Owner. For some it is a good move, for others it’s a nightmare. If you’re looking to sell your home as a FSBO I can help you avoid the traps and legal liabilities as well as show you how to get more money for your home. Purchasing a home from a FSBO is tricky. Protect yourself from some big mistakes buy using a buyers agent. If you need more information, drop me an email.

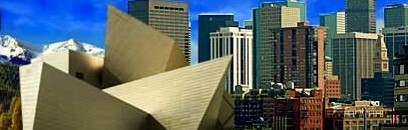

Capitol Hill Condo

“Tracy is the best!! She sold our 1 bedroom condo in a Historic Register building in Capitol Hill in Denver. Unlike many realtors who are just looking to make a sale and move on to the next, Tracy really cares about her clients and their financial situation. She actually convinced us not to sell the first time we contacted her because the market was in the pits and our condo was worth less than 1/2 what we paid for it. By following her advice and waiting a few years, we ended up making money on the condo when it sold for OVER the asking price. She was incredibly patient with all of our concerns and questions, and knows more about the market than anyone. Also worth mentioning that we were out of state for the whole process, so she handled EVERYTHING; renovations, cleaning, staging, pricing, showing, you name it! She made this very stressful situation much less so, and we can’t imagine using anyone else.” – Keith Orell

“Tracy is the best!! She sold our 1 bedroom condo in a Historic Register building in Capitol Hill in Denver. Unlike many realtors who are just looking to make a sale and move on to the next, Tracy really cares about her clients and their financial situation. She actually convinced us not to sell the first time we contacted her because the market was in the pits and our condo was worth less than 1/2 what we paid for it. By following her advice and waiting a few years, we ended up making money on the condo when it sold for OVER the asking price. She was incredibly patient with all of our concerns and questions, and knows more about the market than anyone. Also worth mentioning that we were out of state for the whole process, so she handled EVERYTHING; renovations, cleaning, staging, pricing, showing, you name it! She made this very stressful situation much less so, and we can’t imagine using anyone else.” – Keith Orell

Hot Summer Real Estate Market Cools

Wonder why your home didn’t sell in a weekend? Here’s a bit of info on the summer real estate market. If you take a look at the graph you’ll see that showing traffic in 2Q 2016 is down quite a bit from the First Quarter of the year. This is no surprise, it’s been the seasonal trend for the last four years. Coming off of a super-heated real estate market this spring, the usual summer “slowdown” feels more dramatic than a political convention. If you’re “lingering” on the market for a whopping two weeks remember that listings don’t always sell in a weekend and not all of them get twenty offers, especially those priced over $350,000. Summer in Denver is not only the real estate selling season, it’s vacation time too! With so much to do in our lovely state, we get up, get out and go more often and our stressed out home buyers need a break. Showings tend to pick up again after the Fourth of July for those looking to make a move and settle in before school starts in late August. That’s the conventional wisdom coming from an unconventional gal.

What I have seen year-after-year is a strong autumn season for real estate sales when the summer buyers have either completed or delayed their purchase and those who want to serve Thanksgiving in a new home come out to play. Same goes for the end of the year when myth tells us it’s a bad time to list a house for sale. My experience has been that winter buyers are fewer, yes, but they are more serious and with our continued lack of inventory many will see the cooler months as a less competitive time to purchase a home. Look for more soon in my next Real Estate Market Update.

The Zing of Zillow

Everybody loves Zillow. I love Zillow. I love how excited it gets buyers and sellers when they see a home they love or what a neighbor’s house is selling for; a useful tool in many ways, for better or worse, it empowers the consumer. I look at Zillow to see what my clients/potential clients are taking as accurate information… and then I do my homework. The #Denver #realestate market is moving so quickly that even agents and appraisers can have a hard time keeping up. Public record algorithms don’t have the ability to distinguish the differences in the quality of one property from the other, upgrades, location, or if there’s a crack house next door. Algorithms don’t call other agents to inquire about that “Coming Soon” sign or have the latest data on solds as it takes some time to record.

The Los Angeles Times recently published an article that lays it out quite clearly. Though a “Zestimate” can have a low margin of error, it can also be alarmingly high. Imagine a scenario where you’re meeting with your perspective agent thinking that your home is worth 26% more than what it will really sell for.

Sellers, armed with the Internet, often have an idea in their heads about their home’s value. When I pull comparable properties, show them what the list vs sold prices are and how many days on market it’s taken those homes to sell, they may find a different story. Sometimes the news is good, based upon my data, their home may be worth more than they think. Other times it can be a let down.

Buyers burn the midnight oil searching Zillow then send me a link to their dream home. When I hit the MLS at 7 a.m. most often I find that this dream home is under contract… or sold three months ago. If you’re looking to buy a home, I’ll send you to REColorado, the consumer website linked to the Denver Matrix MLS I use so we can work together efficiently. It’s updated throughout the day, has great home search capabilities and saves me time looking for your real home, not the one someone’s already moving in to.

All this to point out that you now have access to a lot of information about my business. A lot of it is helpful and a whole lot of fun, but none is as accurate as hiring a professional; one who specializes in finding the right home in the right neighborhood that suits your needs. If you’d like an “Exact-i-mate” about what your home might sell for in today’s Denver market, give me a call I’d be glad to sit down with you and show you your market value and why.

Multiple Offer Situation in Denver’s Park Hill Neighborhood

Denver is a crazy-hot real estate market right now with low inventory and multiple offer situations, especially in desirable neighborhoods like Park Hill. Whether you are buying, selling or both, you’ll need to be very prepared and your first step is finding the right Realtor®. Listen to what the Bernuths have to say about their experience.

Jim and Mary Bernuth wanted to downsize from their beautiful Congress Park bungalow to something smaller but with the same charm.We looked at many homes but the heat turned up when their Congress Park beauty went under contract. Like most current sellers, they were nervous about finding the right replacement home and timing both transactions to make a seamless move. We found “The One” and quickly put in an offer… which was rejected. The sale of their home was complicated on the buyers’ side, adding to the stress. Thank you, Jim and Mary, for sharing how it turned out for you and why you recommend TracysDenverHomes for your real estate needs. Click here for more information on the current Denver market.

2015 Real Estate Market Review

As the clock ticks toward year’s end, it’s time to review the 2015 real estate market.

As the clock ticks toward year’s end, it’s time to review the 2015 real estate market.

When someone asks me how the real estate market is, the cocktail party answer is that it’s been a very pleasing 12 months and future looks bright and shiny. Because the economic news is good our Denver Metro real estate market is projected to stay strong but not overheat. I’ll share some of the metrics I use to evaluate the market and understand it better, describing what 2015 looked like and where I think we’re headed.

Market strength–2015 was an extremely strong seller’s market. The market strength peaked in the spring when the bottom dropped out of our inventory and multiple offers were all the rage. Frustrating for buyers who felt they had to give away so much to stay competitive, the good news is that the market reacted appropriately and became more balanced as the year progressed. With prices on the rise, sellers were motivated to sell as we approached the fall so the market cooled with the start of school and the weather. It is still a strong seller’s market, but far more in balance. I expect 2016 to continue along this line and see no sign of a major imbalance that could lead to any sort of ugly peak and crash. Sellers should get a good price for their homes and replacement properties should not be as hard to find.

Buyers– Real estate website Trulia says that buying an average home in Denver is a whopping 38 percent cheaper than renting a home! For the average home, the interest rate would have to skyrocket to 11 percent for renting to become cheaper than buying, meaning that it is currently MUCH more affordable to buy than to rent. Even with current prices and current rents, interest rates would have to nearly triple to make renting more affordable than owning. (Call me if you want to talk about this.)

Sellers-Can’t say this enough: the most important thing to prepare your home for sale is to get rid of clutter. This includes furniture. You may have learned to live with that cherished armchair stuffed into the corner but a professional stager will often times whisk away half of your furniture. The house looks so much bigger for it, leaving space for a buyer couple and their agent to tour the home without bumping into each other, and space for their imaginations to make it their own. You don’t have to go “Stager drastic” but take a hard look, be objective, and see what you can live without. Painting always pays for itself and statistics show that springing for a staging company is often a good investment.

Rental Vacancies– The rental market is stronger than it has ever been in metro Denver. The vacancy rate for 1- to 4-unit properties is an extremely low 2 percent. That’s a drop from the already 4.7% we’d been experiencing for the past few years. On top of this, rents are rising faster than ever, up 30% in the past three years. With rents equaling a mortgage payment, we’re seeing more renters making the decision to buy. Why live waiting for another rent increase, tough competition and another application process without building any equity? Many homeowners who lost their homes in the downturn and have been renting, are becoming eligible to purchase once again. This is great news for the market and will certainly lead to more sales in 2016, though the influx of buyers insures a continuing seller’s market.

Interest rates– No one knows exactly what interest rates will do in the future but my best guess is that they may rise a little in 2016, but only a little. Remember that the Federal Reserve has control over only short-term, not long-term interest rates. Even if the Fed raises rates, that doesn’t directly affect the 30-year home buyer interest rate you are concerned with. Long-term interest rates are affected by the bond market (as bond prices decrease, interest rates increase) which, frankly, is not predictable. Understand though that interest rates are at near 50-year lows so they are highly unlikely to fall any further. All we know for sure is that someday they will go up.

The Economy– No matter what you may hear in the months leading up to the election (places hands over ears), right now the metro Denver economy is very strong. This is fueling our terrific real estate market and the rising population of our city. The unemployment rate is extremely low, about 3.5 percent. Inflation will stay in the range of 1-2 percent, our population is rising at a rate of 50,000 people/year and consumer confidence continues to rise. Nothing can be better for the housing market than a strong and steady economy.

Mortgage -The single most important number for a home buyer is their FICO score. For good or bad, your FICO plays a major role in your ability to finance your home purchase. Your credit score is a snapshot taken by the three leading credit bureaus, TransUnion, Equifax and Experian, to help lenders determine what sort of credit risk you are. Your FICO is a number between 300 and 850 and is calculated by a complex algorithm assessing your past credit history. Most home lenders will consider a score over 700 to be excellent while scores below 600 are considered poor. The better the score the more credit will be extended, at better terms, with a lower interest rate. The best credit terms are extended to consumers with scores above 740. Therefore, it’s critical to understand what your FICO is and what you can do to improve your score. When I work with buyers I help them understand the factors affecting their score so they can work to improve them. I can’t think of a better investment in your future than to spend a little time working on your FICO score.

Here are a few tips I give my clients:

1.Don’t max out your cards, try to keep them under 50% of available credit. Running high balances can severely impact your FICO.

2.Continue paying your bills on time.

3.Don’t apply for new credit or cancel an old card because length of credit helps.

4.Pay down high balances.

5.Dispute and resolve any inaccurate items in your credit report.

6.Invest in a credit monitoring company to track the changes to your score.

September Real Estate News

I’m frequently asked where the real estate market is headed and when we will get back to some kind of equilibrium. The truth is it’s extremely difficult to accurately predict the future but here’s what I know: Right now we are experiencing one of the strongest seller’s markets in our history and we’re a full six and a half years into this market recovery. The reason is simple: we have much more demand for homes (buyers) than we have supply of homes (sellers). What’s fascinating to watch is the dynamic build on itself. It looks something like this:

I’m frequently asked where the real estate market is headed and when we will get back to some kind of equilibrium. The truth is it’s extremely difficult to accurately predict the future but here’s what I know: Right now we are experiencing one of the strongest seller’s markets in our history and we’re a full six and a half years into this market recovery. The reason is simple: we have much more demand for homes (buyers) than we have supply of homes (sellers). What’s fascinating to watch is the dynamic build on itself. It looks something like this:

1.Buyers make offers on homes and continue to lose out to higher offers.

2.Buyers get increasingly frustrated and begin to get more aggressive with their offers.

3.The momentum builds on itself until we see what is occurring today, with multiple offers on a propertythe norm rather than the exception.

4.The multiple offer dynamic almost always bids prices higher than the original asking price.

5.The buyers that lose the bid learn from the experience and become more aggressive on their next offer.

6.Then back to Step 1, until the buyer bids high enough on a property to finally get an offer accepted.

The result of course is the tremendously strong seller’s market we have experienced for the past several years. And this seller’s market is not going to change any time soon, at least not until we get back to some kind of balance in the market between buyers and sellers. I don’t see that happening for at least several more years. In the meantime, if you’ve thought about selling your home, now might be a great time to find out what the market is like in your neighborhood and see what your home is worth. It’s almost certainly worth more than it was just a few years ago. Drop me a line and I’ll put together a professional Competitive Market Analysis on your home so you have the data to make the right decision.

Another question my potential sellers often ask is if they sell today, can they find a replacement home in time to move? In a market like ours this is a very good question. Fortunately, there are a number of things savvy sellers can do to take advantage of the seller’s market and put themselves in a good position when looking for their replacement home.

Here are a few:

1.First and foremost, work with an experienced agent to write a strong, professional offer on the home you want to buy. In a dramatically competitive market like we have now, weak, poorly written, unprofessional, and bad offers just aren’t taken seriously. There is both an art and a science to writing a strong offer. Call me and I’ll explain more about how to write an offer that has a great chance of getting accepted.

2.Add a contingency clause to your contract to buy another home. The clause would say that you will close on the home you are purchasing once your own home sells. The problem with this is that it somewhat weakens your offer as many sellers don’t want to accept a contingency when they can sell quickly to the next buyer. But occasionally we do run across a seller that is in no hurry and is happy to wait for the buyer’s home to sell.

3.Lease the home you just sold from the buyer for a period of time while you are looking for your new home (this is called a lease back). Some buyers do not want or are not able to move into their new home immediately and this permits them to earn rent from you for the period of time you are shopping for your next purchase, a win-win situation. 4.Look into a new construction purchase. Builders are building as fast as they can in this market to keep up with demand and there may be inventory of completed or soon-to-be-completed homes that could suit you. 5.Arrange to stay with family or move into short-term rental housing until you find your next home. While not a perfect solution I believe it’s far better to inconvenience yourself for a short period of time than to settle for anything less than your dream home!

“Denver apartment rents rising three times the national average”

This was the Denver Business Journal’s Sept. 2 headline. Denver rents have increased another 7 percent in the past year, which is three times the national average of 2.3 percent. And given the continued lack of rental inventory, rents are expected to continue increasing at a strong pace. Sooooooo…. 1.If you’re a renter it might be time to consider looking into buying a home to get out of the rental market madness! 2.If you’ve ever thought about buying a rental as a long-term investment now might be the time to learn how to purchase a safe, cashflowing property. Interest rates are still near record lows and rents havenever been higher, a wonderful combination for any real estate investor.

Mortgage rates continue to hover at near-record lows. For homeowners looking to upgrade to a larger, better home, low rates combined with low home inventory are making this a great time to upgrade to a larger home with very nearly the same monthly payment. We have several recent examples of clients selling their current homes and getting into a $40,000 – $50,000 more expensive home with the exact same monthly payment. Please give me a call or send me and e-mail and I’ll do a free analysis to see if this might be a good scenario for you to take advantage of.

Brick Ranch For Sale in Montclair (Click here).

I fell in love with this cute little brick ranch home in Denver’s Montclair neighborhood the moment I opened the door! There was a sign in the yard, FOR SALE BY OWNER but I just knew I had to list it! The front of this brick ranch home is sweetly elegant. There are three bedrooms/ two baths, beautiful hardwood floors, a very charming vintage full bath upstairs and a bright white kitchen.Your kitchen window overlooks Kittredge Park so you’ll always have the feeling of open space and natural light streaming through your windows. The basement is fully finished and has a non-conforming bedroom, nice sized great room and nifty little space for an office, study or guest room (I love the custom built-in bookshelves!). The back yard is private and just the right amount of space; not too much to keep up, but plenty of room for the gardener, the dog, or both. Enjoy a summer party under the covered patio and give me a call when you do! Did I mention the giant garage? Well it has a really nice, big garage. Click the link above to see the video and call me if you’d like to see it. Or just call and say hello!

May Shows Denver Real Estate Market’s Upward Trend

Notes from the Denver Real Estate Market trenches: I’m seeing a lot, and I mean a LOT of multiple offer situations and better luck shopping for homes during the week rather than the weekends. Savvy listing agents are holding open a date when offers will be presented to allow maximum exposure and showings, then driving buyers to compete and close. Buyers, tired of this cycle and anxious to get under contract, are getting good at moving quickly and great buyers’ agents (that’d be me 😉 are adept at writing strong offers that will get accepted. A few oddities I’ve noticed: homes are coming “Back on Market” after being Under Contract and I’m seeing price reductions. The first tells me that Buyers may be getting caught up in the feeding frenzy and, wanting to win, may offer more than they’re comfortable with. There could also be inspection issues but what I’m seeing doesn’t look like it fits into that time frame. The second one, price reductions, indicates that there may be listing agents and sellers who enter the market over-confident with their pricing and need to adjust.

Notes from the Denver Real Estate Market trenches: I’m seeing a lot, and I mean a LOT of multiple offer situations and better luck shopping for homes during the week rather than the weekends. Savvy listing agents are holding open a date when offers will be presented to allow maximum exposure and showings, then driving buyers to compete and close. Buyers, tired of this cycle and anxious to get under contract, are getting good at moving quickly and great buyers’ agents (that’d be me 😉 are adept at writing strong offers that will get accepted. A few oddities I’ve noticed: homes are coming “Back on Market” after being Under Contract and I’m seeing price reductions. The first tells me that Buyers may be getting caught up in the feeding frenzy and, wanting to win, may offer more than they’re comfortable with. There could also be inspection issues but what I’m seeing doesn’t look like it fits into that time frame. The second one, price reductions, indicates that there may be listing agents and sellers who enter the market over-confident with their pricing and need to adjust.

Remember, a house is not a hamburger. You can’t just show pretty pictures and charge what you like. A house is an emotional commodity and only worth what a buyer is willing to pay for it. So… even in a Sellers Market, the Buyer dictates the price. Now, on to the data from Metrolist:

DENVER – June 6, 2014 – Signaling the start of the summer buying and selling season, the real estate market for the Denver metro and surrounding area saw increased activity in May as buyers scooped up available inventory despite near record prices.

The pace of home sales picked up during the month of May, as the number of sold properties rose 19 percent month over month. In particular, demand for single-family attached homes saw a marked increase, rising 25 percent over last May.

Inventory in the Denver area continued its upward trend, as active listings increased 15 percent from April, and the number of new listings climbed 11 percent month over month. However, the market is still very competitive, as days on market saw a 17 percent decrease in May. Homes are moving quickly, averaging only 29 days on the market.

“We have seen a very active start to the summer selling season. The market is moving quickly, but an increasing inflow of new listings is a positive sign,” said Kirby Slunaker, president and CEO of Metrolist. “The market absorption rate highlights a high level of demand for properties and a reduction in days on market.”

The average single-family attached+detached property spent just 29 days on the market in May, down 34 percent over last year. There is currently a supply of just seven weeks’ worth of inventory in the Denver metro and surrounding area.

Continuing a 36-month trend, average sold prices were up 2 percent from April. Prices for single-family attached+detached homes reached $333,955, up 8 percent.

“As the largest MLS in Colorado, we are committed to providing agents and consumers with innovative tools and resources to navigate their way through this fast-paced sellers’ market,” said Slunaker. “In addition to having the most accurate, current and up-to-date property information, REcolorado.com is providing new innovative tools such as INRIX Drive Time™, which is available to assist consumers in making educated decisions as they work with their REALTOR®.”

About REcolorado.com

Before entering the market, buyers and sellers can get free access to up-to-the-minute housing information throughout the state of Colorado at REcolorado.com. The website offers advanced search features and filters for price and location, as well as home values and scheduled open houses. This comprehensive local resource enables both buyers and sellers to enter the housing market well informed.

About Metrolist: Metrolist is the largest MLS in the state of Colorado, supporting the largest network of REALTORS® with the most comprehensive database of real property listings throughout the Front Range. Realtor-owned since 1984, Metrolist provides leading technology solutions to real estate agents and brokers to better serve buyers and sellers. More information about Metrolist is available at www.REcolorado.com.

Denver Home Prices Rise Again

According to the latest monthly Case-Shiller Home Price Index, Denver-area home-resale prices rose an average 9.1 percent in March from a year earlier. Prices were up 1.4 percent from February, reaching an all-time high. One reason for this, as you may well know, is that our inventory is still incredibly low. Last spring, when the market suddenly turned, we thought this was a fluke but a year out, this seems to be the new norm. Click here to read more in the Denver Business Journal.

What does this mean for you? SELL! I have clients who made a move up during the leaner years and if they were able to hold on to their first property and buy their second, that’s what I’ve encouraged them to do. Rental income and market appreciation made this a wise move for many and now that equity is allowing them to sell at a tidy profit. I’m all for real estate investing and for having a buy and hold strategy in your portfolio, but you need to ask yourself if that is the best use of your money right now. Sometimes an investment has peaked and/or life has changed drastically, providing other options or shall we say ‘rearranging priorities’?

Buyers and sellers are often hesitant to sell for fear of finding a replacement home and though the market is swift like a snowmelt stream, I’ve yet to move one of my clients into a hotel or a shelter. All things are negotiable.

So if you’re looking, or thinking about looking., selling or wondering if selling is your best option, I’d love to sit down and have a conversation with you.

![2Q16 Showing Traffic - TShaffer [4151395]-page-001 (1)](https://tracyshaffer.com/wp-content/uploads/2016/07/2Q16-Showing-Traffic-TShaffer-4151395-page-001-1.jpg)