According to the latest monthly Case-Shiller Home Price Index, Denver-area home-resale prices rose an average 9.1 percent in March from a year earlier. Prices were up 1.4 percent from February, reaching an all-time high. One reason for this, as you may well know, is that our inventory is still incredibly low. Last spring, when the market suddenly turned, we thought this was a fluke but a year out, this seems to be the new norm. Click here to read more in the Denver Business Journal.

What does this mean for you? SELL! I have clients who made a move up during the leaner years and if they were able to hold on to their first property and buy their second, that’s what I’ve encouraged them to do. Rental income and market appreciation made this a wise move for many and now that equity is allowing them to sell at a tidy profit. I’m all for real estate investing and for having a buy and hold strategy in your portfolio, but you need to ask yourself if that is the best use of your money right now. Sometimes an investment has peaked and/or life has changed drastically, providing other options or shall we say ‘rearranging priorities’?

Buyers and sellers are often hesitant to sell for fear of finding a replacement home and though the market is swift like a snowmelt stream, I’ve yet to move one of my clients into a hotel or a shelter. All things are negotiable.

So if you’re looking, or thinking about looking., selling or wondering if selling is your best option, I’d love to sit down and have a conversation with you.

Color Me (Re)Blue

One of my favorite things about being in real estate is looking at houses. I’m mad about architecture, color, design, shape and style. I love staging that brings out the best features in the home while keeping it homey. Watching home improvement shows, HGTV, and all that real estate porn… I must admit, excites me. And when January rolls around and the color wizards announce the nominees, I feel as dizzy as an ingenue on Oscar morning.

One of my favorite things about being in real estate is looking at houses. I’m mad about architecture, color, design, shape and style. I love staging that brings out the best features in the home while keeping it homey. Watching home improvement shows, HGTV, and all that real estate porn… I must admit, excites me. And when January rolls around and the color wizards announce the nominees, I feel as dizzy as an ingenue on Oscar morning.

On any given power-shopping Saturday, I can take buyers to look at five to fifteen properties. After house number 10, you’re beginning to feel a sense of overwhelm and the ‘buyer’s blur’, as each house starts to blend into the next. As the day progresses, the copious notes you started out taking become chicken scratches or a simple “NO!” until you get to my favorite place… walk in, walk out.

At the beginning of a house hunt, we feel the need to take the time to visualize ourselves in the home, our colors on the wall and grandma’s hutch in the dining room. Once you get the “Blur” it’s like triage, you identify what’s wrong quickly and assess if you can fix it or if you have to move on.

So sellers, what is it that buyers are responding to? First off I’d say CLEAN. And I mean clean to the point that a team of pros came in and scrubbed every corner with a toothbrush! Even an old house will look new when it’s sparkling clean. It inspires trust, helps us believe you’ve taken good care of your home. And by all means DECLUTTER. I know you’ve heard this before, from me and a thousand other HGTV Realtors, because we’re right. We’re the ones in the house when you’ve left for the showing and we hear EVERYTHING. When I say declutter, I don’t mean get rid of those things you’ve been planning to take to the Goodwill, I mean take all that to the Goodwill and then come home and pack up half of what you own!

Now comes the good part; UPDATE! The new 2013 colors are out and they are sensational. Spend some time browsing around to see if there’s something that speaks to you. If you’re prepping to sell (and right now you should be), look at the new neutrals, look at the latest accent colors and see if there’s something you can do to make your home feel au currant. You’re going to have to break out the paint brush, may as well add some pop! A word of caution though, if you’re not comfortable taking the lead on this bring in a color consultant or a stager for a professional eye. It can make a big difference in how much your home sells for and how quickly it sells.

The Denver market has changed. Home prices are up a stout 7% but that doesn’t mean you can just plant a sign in the yard and ask top dollar. If you want the most for your home, put the most into it. I guarantee you, that’s what your neighbor’s doing.

So… I guess it’s time to start moving on moving.

Winter Home Buying? You bet your ice skates!

After you’ve finished your holiday shopping, why don’t we go look for a house?

Winter home buying has its challenges, but winter can be the perfect time to buy a home. As we head toward the snowy months, serious shoppers know their winter home buying power is increased by determination and AWD. Housing market prediction for 2014 is looking good and buying a home this winter might just be the ultimate stocking stuffer.I love me those cold weather clients!

Most people think of buying or selling their homes in the ‘high’ season, and while the balmy days of spring and summer are perfect for cruising open houses and power shopping, they also bring the crowds. In 2013 we saw a big bump in the Denver housing market:lots of buyer activity and low inventory meant happy sellers and buyers who were frustrated by the return of the multiple offer. Even when the market was down the notion that summer is the best time to buy/sell your house is one that is hard to break. After spring break, sellers prepare to list the moment the last school bell rings pushing inventory up and in the seller’s minds prices too. Many of these listings are sellers who want to test the waters, plant a For Sale sign in their yard along with the annuals and see if they get the price they want. But this supply side increase often works in the buyers’ favor or frustrates them when the fair-weather seller lacks the motivation to agree on a fair price. Sellers feel the same when sunny day buyers, indulging in some fantasy house hunting, create lots of traffic and little else.

Cold weather buyers and sellers are serious.

The real estate market is driven by many factors but the first and most enduring one is CHANGE. One of the most enduring reasons people buy or sell a home is because their lives are in transition. Though many plan their home sale or purchase, life happens without regard to season or convenience. Families change, jobs are gained, lost or relocated, promotions happen, marriage, divorce, birth and death– all create someone with a housing need.

Shopping or selling in a Denver winter are obvious– driving in show, slipping on ice, shoveling the walkway, taking your boots on and off so you don’t track sludge into the house, fewer showings– but the buyers are BUYERS and not just lookers. Winter sellers are ready and willing to make a move, and tend to price accordingly from the start. The slower season also means that lenders, title companies and appraisers are not so swamped, smoothing out the process and lowering emotion. And of course, there are fewer people submitting offers on your dream home.

As savvy shoppers know, the post-holiday season comes with plenty of opportunities for a bargain and that includes houses as well. Though we in Denver are beyond the clearance sale in our housing market, home prices are on the rise giving sellers more leverage as well.

Enjoy the holidays, spend time with your loved ones, take a spin around town and take in the lights. Then call me when you’ve got the ornaments put away and we’ll get the ball rolling.

How would it affect you if you could no longer write off the interest you pay on your mortgage?

According to panelists at Friday’s housing forum hosted by Zillow and the University of Southern California’s Lusk Center for Real Estate:

The burgeoning federal debt makes it unlikely that the mortgage interest tax deduction will survive in its present form. Of course, any proposed changes to the tax break for homeowners will spark a fierce debate over the fundamentals of the U.S. housing market, the value of home ownership, and consumer behavior.

“Fierce debate” he says? I’d call it a jobs-killer! But then again, I’m in real estate. Change is never easy, but when it hits our pocketbooks and the government, it really hits home. I advise my clients to educate themselves, talk to their tax professional and view the tax benefits icing on the cake. Knowing the long-term financial upside leaves them feeling good and more secure as they move forward with their biggest single purchase.

“I think it’s entirely likely that something big is going to happen (with the MID) starting next year with either administration,” said Jason Gold, director and senior fellow at the Washington, D.C.-based Progressive Policy Institute, an independent think tank.

A Congressional contingent advocates for the elimination of the mortgage interest deduction to help address the nation’s debt and budget deficit. Obviously things must be done to right the problem, but sticking it to a Middle Class whose beginning to feel the effects of a post-crisis housing market recovery seems a bit harsh. At the end of this year, a series of tax increases and spending cuts are scheduled to go into effect automatically unless Congress acts to prevent or alter them. Revamping the mortgage interest deduction is on the table as a way to head off that “fiscal cliff” scenario. (I wonder how many of those guys have a mortgage.)

Two years ago, a bipartisan deficit reduction commission recommended scaling back the mortgage interest deduction, which is currently capped at mortgages worth up to $1 million for both principal and second homes and home equity debt up to $100,000 and the deduction is only for taxpayers who itemize.

The Simpson-Bowles commission proposed turning the deduction into a 12 percent non-refundable tax credit available to all taxpayers, capping eligibility to mortgages worth up to $500,000, and eliminating the deduction on interest from second homes and home equity debt.

Though that seems more reasonable to me than the first idea, the National Association of Realtors has consistently defended the mortgage interest deduction in its current form.

Highly critical of the recommendation and claiming any changes to the MID could depreciate home prices by up to 15 percent, they are promising to “remain vigilant in opposing any plan that modifies or excludes the deductibility of mortgage interest.”

So… we’re back to whose going to pay down the debt? And how.

The MID is a “tax expenditure,” meaning its cost must either be made up through higher taxes elsewhere or by adding to the debt, and it costs the government about $90 billion a year. Richard Green, the director of the USC Lusk Center for Real Estate, told forum attendees that reforming the MID is necessary for fiscal sustainability. “We need to get revenue,” Green said. “You need to make a judgment about what’s better or worse for the economy. In my opinion, it’s better to do it with tax expenditures, rather than rates, though you may have to do both to get to where we need to be.”

Because mortgage interest rates are currently so low, he added, “This may be an opportunity to do less damage by reforming the mortgage interest deduction than at other times.”

(I wonder what cuts would make this guy feel the pinch.)

The mortgage interest deduction is particularly polarizing because of the disconnect between how people use it and how it is perceived. Green gave the example of Texas where most people do not itemize their taxes (only about 30% of taxpayers do) so they cannot take advantage of the MID. This line of thought perplexes me. So… if more Texans itemized their taxes it would make things fairer? or does he mean that if they actually knew they could they would, adding to the deficit? And haven’t Texans done enough of that? 😉

No matter how the chad falls in the next three weeks, watch for ongoing and loud debates over the Mortgage Interest Deduction. *covers ears*

Source: Inman News, Andrea V. Brambila, Monday October 15, 2012

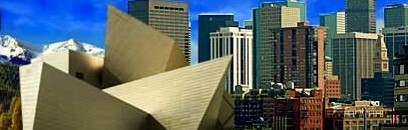

And don’t we all need a little good news? Working in the real estate trenches I’ve been watching the steady turn around, especially evident in 2012 as the Denver real estate market took a sharp turn for the better. Today’s Denver Business Journal announced the data to back up my experience.

And don’t we all need a little good news? Working in the real estate trenches I’ve been watching the steady turn around, especially evident in 2012 as the Denver real estate market took a sharp turn for the better. Today’s Denver Business Journal announced the data to back up my experience.

Colorado’s housing market stands out as the fifth-strongest in the country, according to the website 24/7 Wall Street.

Home prices across the state have increased by an average of 7.3 percent over the past year, putting Colorado between North Dakota (7.1 percent) South Dakota (8.3 percent). The ranking was based on a review of data from various sources, including the CoreLogic Home Price Index and foreclosure reports from RealtyTrac. 24/7 Wall Street forecasts Colorado home prices will increase by 3.7 percent between the first quarter of the year and the first quarter of next year.

Good news for the Dakotas, but we get to live in Colorado! If you’d like more information about your neighborhood or how you can make this market work for you, call, text, email or comment here and we’ll talk.

The Denver rental market is more than just healthy; it’s got a rosy glow. With vacancy rates low, prices for rental properties have risen and according to Poppy Harlow of CNN’s Early Start, Denver is one of the top five cities for rent increases, 10.9% over the past twelve months. That’s great news if you’re a landlord!

The Denver rental market is more than just healthy; it’s got a rosy glow. With vacancy rates low, prices for rental properties have risen and according to Poppy Harlow of CNN’s Early Start, Denver is one of the top five cities for rent increases, 10.9% over the past twelve months. That’s great news if you’re a landlord!

As the market fell and foreclosures soared, I have been focused on helping clients build wealth through investing in rental properties. Where are you going to move when you lose your home? A clean, safe, single-family home to rent where their lives and families can live and recover from the ordeal they’ve been through would be ideal. Many of these tenants would have had no problem paying their mortgages had they stayed at the pre-adjusted interest rates, or the troubles that befell them has passed. They are willing and able to pay good rent for a well-kept property that makes them feel back in balance. A recent survey on the rental market bears this out.

After surveying property managers, TransUnion found that increasing prices aren’t keeping tenants away. Overall, managers reported they are doing better than the year before and are having an easier time attracting in residents despite the increase in prices.

The credit bureau’s June survey included 1,248 property managers across the U.S. who represented a range of property sizes.

Read the Survey: Rental Market Attracting Residents Despite Price Increases. and let me know what you think.

There are some very attractive deals out there for those who want a good annual cash-on-cash return on their investment that owning real estate investment property provides, but the market is moving swiftly. I would recommend you do as well. “I don’t want to be a landlord” you say? I can help you with that through a few concise classes or introduce you to some affordable pros.