Working as a professional actress has taught me many things: tenacity and humility for one. (Ha!). Along with the starring roles and the smaller roles come the understudying gigs. They’ve kept me on my toes, fully insured and employed. Largely the experience hasn’t been in the glamorous, deceitful, clamoring-for-fame vein portrayed in the 1950 film classic, All About Eve, mine have had been more in line with the Girl Scout motto.

Three decades in the industry has kept me ambitious, created a strong work ethic and instilled a somewhat healthy insecurity that feeds my drive. Pounding the pavement, perpetually prospecting and practicing persistence is the perfect training ground for a career in the real estate business, but nothing could have prepared me for spring of ’13.

After Romeo & Juliet, my first foray into the First Folio, I was looking forward to a seasonal ramp up in the real estate world and my end of season gig at the Denver Center Theatre as understudy in “Other Desert Cities”. Shoulda been a cakewalk, it was not.

The rapid acceleration of the Denver housing market coincided with my ascension from understudy to starring role and the first audience in just eight days. (Actually it was a 5 character ensemble play, but ‘starring role’ does sound, well… more dramatic). Time to drill down and focus on my lines; stringing together the beads of this complex and demanding character would come later. I was hitting the wall as we hit our “10 out of 12”, theatre speak for long-ass day, when an offer came in on my hot Congress Park listing. Negotiating a deal and my way around the stage, I had to find my clients a replacement home. Dinner breaks became showing appointments, opening doors as my lines streamed through my headphones, I existed on chocolate bars and power naps until… “You’re on, Eve.”

The show opened, the clients closed on their new house and the actress/Realtor spent a week in Vail recuperating, which is important as the pace has not slowed. The message of my Girl Scout leader, BE PREPARED, has a whole new meaning with the real estate market at a break neck pace. “Prepared” to drop what you’re doing to snap up a showing on a snappy place, “prepared” with a purchase contract ever-ready on the tablet, “prepared” to list a home on Thursday, hold it open on Saturday and present offers on Sunday. “Prepared” went from having snacks and water in your ditty bag to performing the above tasks for multiple clients, sleeping very little, and loving it. If you’re looking to buy or sell a home, or both, I still have some treats in the ditty bag. Mostly chocolate.

Denver housing market, news and trends.

How do you do it, oh friends of mine? Vacate your premises in a timely fashion while living your lives, raising your kids, working your jobs and closing your loans. I’ll bet your boxes are properly labeled, too.

I just moved. Or more specifically, some very strong men came to my house, loaded a truck full of my belongings drove them across town and unloaded them in my new abode. I’ve made numerous trips along the same trail with countless loads of boxes, files, photos, artwork and armloads of clothes. It took them about three hours, it’s taken me months. The new house is coming together, the old one is being prepped to sell, and aside from the stubbing of toes I am in heaven…and hell.

I’m a pretty organized person. I know where I put the Phillips screwdriver, keep the chaos at arm’s length and can crush a to-do list with one hand. None of this prepared me for a move.

I started with plenty of time, and then a flurry of good fortune took a hold of my life, leaving me with higher priorities than packing tape and ARC pick-ups. As I chipped away in what little spare time I had, I found little energy for the real task at hand, DECIDING. Every single thing you own must be dealt with, handled, and decided upon: does it have purpose or does it have meaning or does it fit? If the answer is no, pitch it. Easy at the start, but soon enough poof skirts are begging for a comeback and junk drawers scream to be sorted through and that eclectic offering called your stuff becomes a living nightmare of need, prompting the ashram fantasy.

“All changes, even the most longed for, have their melancholy, for what we leave behind us is a part of ourselves; we must die to one life before we can enter into another.”

– Anatole France

As a Realtor I facilitate this transition for others every day, managing the details of the business transaction while they care for the mountain of moving minutia, but it’s a whole ‘nother Oprah when you’re the one moving that mountain. Whether initiated by you or forced upon you, change is always a molecular shake up. No matter how much you anticipate a benevolent future or care to close a chapter of the past, a move holds all the complexities of closure. I am an expert in change; life has thrown me more curves than the Coney Island Cyclone and I’ve gotten pretty good at it. This one is one I have created, and though I have a few ideas about why (urban living, closer to my community, more manageable home, #EastHighSchool) I know there is still much to learn in the process aside from where to put the guest towels. As soon as they find their place, I am receiving.

New listing in Denvers HOT, HOT, HOT WHITTIER neighborhood! Close to everything, the block is on fire with homes going in the 500s, this half-duplex has recent comps above 200. The perfect solution for the renter who wants to build equity or those who want an alternative to condo living with a sweet little back yard for your tomatoes or your ‘doodle’. 2438 Gilpin will be open Saturday 12-4.

But My Brother’s Wife’s Uncle’s Best Friend’s Daughter Sells Real Estate…

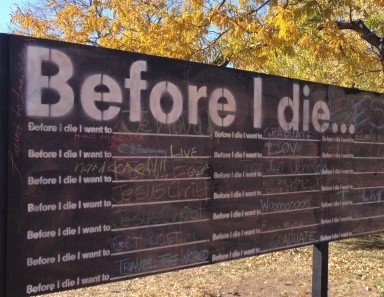

Before I Die… A Community in Communion

Before I die, I want to…

Driving the streets north of Downtown Denver one might turn some dodgy corners. The gentrification of Curtis Park, Ballpark and Five Points neighborhoods has pushed up real estate prices as artist lofts and galleries, restaurants and the urban infill townhomes that follow, found their place beside the old Victorians. This quilted mix of luxe and lush is what gives the area its unique charm, but if you’ve ever stopped at a red light near one of the triangle parks you may have wondered… why doesn’t somebody clean that up? Often dirty, neglected and filled with those for whom a triangle in traffic is as close to home as they have, these inauspicious spaces have fallen through the cracks. So, whose responsibility are they?

Meet the Community Coordinating District No. 1, whose job it is to transform these hot spots into vital, safe and manageable environments for those who live and work in the area. Community works best when in communion; yet all too often disparate interests work, immune to or in spite of one another, making civic progress slow if not impossible. Created as an ad hoc adjunct “collaborative policy platform”, the CCD brings together government, public, non-profit and private sector organizations to facilitate those public improvements which are often dreamed up and less often realized. Adding working capacity to city-led initiatives, creating opportunities for revitalization and economic development, the CCD will scout out areas of the city that need attention and make sure they get it. Think of them as Denver’s Den Mother.

Born in 2010 as the brainchild of a collection of civic visionaries who’d been trying for decades to improve the areas northeast of Downtown Denver, the Community Coordinating District works across geographical boundaries to unite community stakeholders and thoughtful partners to leverage their assets, pool their resources and more efficiently effect change throughout the city.

Targeted areas of enhancement are Eddie Maestes Park directly across from the Denver Rescue Mission at Park Avenue West and Broadway. Long known as a staging area for the homeless, the park has been riddled with crime and drug-related activity. Rather than just “displace” these issues, the District is exploring opportunities for positive change and working through plans to implement them.

Last summer, Sonny Lawson Park gained some renewed energy with the installation of “Before I Die”, a world-wide, interactive art piece by Candy Chang . The interactive mural is like a giant blackboard with the words “Before I die I want to…” painted on it as a universal writing prompt. Visitors are encouraged to pick up a piece of chalk, reflect on their lives, and share their personal aspirations in a public space. The original Before I Die… mural was installed in New Orleans, where Chang transformed the side of an abandoned house in her neighborhood into a giant chalkboard and stenciled it with the sentence. By the next day the wall was entirely filled out and it kept growing. The wall turned a neglected space into a constructive one where neighbors had an outlet to get to know each other and remember their loved ones.

Having been installed in more than 20 countries around the globe, Candy Chang’s Denver incarnation has made its way downtown, where it lives outside the newly renovated McNichols Building at the corner of Colfax Avenue and Bannock, inspiring denizens through February.

The Community Coordinating District offers many opportunities for civic engagement and public participation through its weekly Monday morning meetings, volunteer ops and upcoming events. Strategic partnerships with Arts & Venues Denver, Department of Health and Human Services, Department of Parks and Recreation, Denver Police Department, Department of Public Works, Denver’s Road Home, Ballpark Neighborhood Association, City Parks Alliance, Curtis Park Neighbors, Denver Biennial of the Americas, Denver Rescue Mission, Redline Gallery, St. Francis Center, Denver Shared Spaces, Ballet Nouveau Colorado/Wonderbound, Betterweather Inc., Dept. of Community Planning and Development, City Councilwoman: Judy Montero and City Councilman Albus Brooks, promise to keep it interesting.

“Before I die…” was brought to Denver through a partnership of Arts and Venues Denver, the Community Coordinating District, Rocky Mountain College of Art and Design, and Denver Design Build LLC. For more information on Denver’s Public Art Program, click or call 720-865-4313.

Color Me (Re)Blue

One of my favorite things about being in real estate is looking at houses. I’m mad about architecture, color, design, shape and style. I love staging that brings out the best features in the home while keeping it homey. Watching home improvement shows, HGTV, and all that real estate porn… I must admit, excites me. And when January rolls around and the color wizards announce the nominees, I feel as dizzy as an ingenue on Oscar morning.

One of my favorite things about being in real estate is looking at houses. I’m mad about architecture, color, design, shape and style. I love staging that brings out the best features in the home while keeping it homey. Watching home improvement shows, HGTV, and all that real estate porn… I must admit, excites me. And when January rolls around and the color wizards announce the nominees, I feel as dizzy as an ingenue on Oscar morning.

On any given power-shopping Saturday, I can take buyers to look at five to fifteen properties. After house number 10, you’re beginning to feel a sense of overwhelm and the ‘buyer’s blur’, as each house starts to blend into the next. As the day progresses, the copious notes you started out taking become chicken scratches or a simple “NO!” until you get to my favorite place… walk in, walk out.

At the beginning of a house hunt, we feel the need to take the time to visualize ourselves in the home, our colors on the wall and grandma’s hutch in the dining room. Once you get the “Blur” it’s like triage, you identify what’s wrong quickly and assess if you can fix it or if you have to move on.

So sellers, what is it that buyers are responding to? First off I’d say CLEAN. And I mean clean to the point that a team of pros came in and scrubbed every corner with a toothbrush! Even an old house will look new when it’s sparkling clean. It inspires trust, helps us believe you’ve taken good care of your home. And by all means DECLUTTER. I know you’ve heard this before, from me and a thousand other HGTV Realtors, because we’re right. We’re the ones in the house when you’ve left for the showing and we hear EVERYTHING. When I say declutter, I don’t mean get rid of those things you’ve been planning to take to the Goodwill, I mean take all that to the Goodwill and then come home and pack up half of what you own!

Now comes the good part; UPDATE! The new 2013 colors are out and they are sensational. Spend some time browsing around to see if there’s something that speaks to you. If you’re prepping to sell (and right now you should be), look at the new neutrals, look at the latest accent colors and see if there’s something you can do to make your home feel au currant. You’re going to have to break out the paint brush, may as well add some pop! A word of caution though, if you’re not comfortable taking the lead on this bring in a color consultant or a stager for a professional eye. It can make a big difference in how much your home sells for and how quickly it sells.

The Denver market has changed. Home prices are up a stout 7% but that doesn’t mean you can just plant a sign in the yard and ask top dollar. If you want the most for your home, put the most into it. I guarantee you, that’s what your neighbor’s doing.

So… I guess it’s time to start moving on moving.

The Game of Having Game

It’s Friday night. The Broncos are in the playoffs and the Mile Hi City is tickled…orange. In Denver, we take our football seriously. Denizens will brave tomorrow’s freezing temps to celebrate at pre-game tailgate parties and freeze their own tails in the stands, while the taste of beer, brats and a Broncos victory creates an excitement that is palpable. It hasn’t been easy for fans the past few years; roster changes, close calls and heartaches have sent tears streaming over many a blue and orange painted cheek.

It’s Friday night. The Broncos are in the playoffs and the Mile Hi City is tickled…orange. In Denver, we take our football seriously. Denizens will brave tomorrow’s freezing temps to celebrate at pre-game tailgate parties and freeze their own tails in the stands, while the taste of beer, brats and a Broncos victory creates an excitement that is palpable. It hasn’t been easy for fans the past few years; roster changes, close calls and heartaches have sent tears streaming over many a blue and orange painted cheek.

So does it take to push yourself over the goal line when your adversaries are strong and your opponents worthy? Sometimes it’s a matter of luck and game. He who wants it the most wins, and as Annette Bening famously shows us in American Beauty… The same goes for real estate.

Hopefully we’re not in character Carolyn Burnham‘s situation, but we can relate to her state of mind. I know I can. It’s not been an easy ride on housing market roller coaster, but now Denver has plenty to be excited about. The real estate market is one of the strongest in the nation, leading the way through the recovery. Home prices up 6.87 percent over a year ago according to the latest Case Schiller report, and mortgage interest rates are looking to remain low through 2013.

There have been times over the past few years when I wondered if it would change and how long it would take. Seeing people suffer has been difficult, helping them through it, gratifying, and somehow… on a wing and a prayer, by luck, pluck, with great cheerleaders and sheer force of will, we’ve made it…just like the Broncos.

It’s coming on game time. GO TEAM.

Winter Home Buying? You bet your ice skates!

After you’ve finished your holiday shopping, why don’t we go look for a house?

Winter home buying has its challenges, but winter can be the perfect time to buy a home. As we head toward the snowy months, serious shoppers know their winter home buying power is increased by determination and AWD. Housing market prediction for 2014 is looking good and buying a home this winter might just be the ultimate stocking stuffer.I love me those cold weather clients!

Most people think of buying or selling their homes in the ‘high’ season, and while the balmy days of spring and summer are perfect for cruising open houses and power shopping, they also bring the crowds. In 2013 we saw a big bump in the Denver housing market:lots of buyer activity and low inventory meant happy sellers and buyers who were frustrated by the return of the multiple offer. Even when the market was down the notion that summer is the best time to buy/sell your house is one that is hard to break. After spring break, sellers prepare to list the moment the last school bell rings pushing inventory up and in the seller’s minds prices too. Many of these listings are sellers who want to test the waters, plant a For Sale sign in their yard along with the annuals and see if they get the price they want. But this supply side increase often works in the buyers’ favor or frustrates them when the fair-weather seller lacks the motivation to agree on a fair price. Sellers feel the same when sunny day buyers, indulging in some fantasy house hunting, create lots of traffic and little else.

Cold weather buyers and sellers are serious.

The real estate market is driven by many factors but the first and most enduring one is CHANGE. One of the most enduring reasons people buy or sell a home is because their lives are in transition. Though many plan their home sale or purchase, life happens without regard to season or convenience. Families change, jobs are gained, lost or relocated, promotions happen, marriage, divorce, birth and death– all create someone with a housing need.

Shopping or selling in a Denver winter are obvious– driving in show, slipping on ice, shoveling the walkway, taking your boots on and off so you don’t track sludge into the house, fewer showings– but the buyers are BUYERS and not just lookers. Winter sellers are ready and willing to make a move, and tend to price accordingly from the start. The slower season also means that lenders, title companies and appraisers are not so swamped, smoothing out the process and lowering emotion. And of course, there are fewer people submitting offers on your dream home.

As savvy shoppers know, the post-holiday season comes with plenty of opportunities for a bargain and that includes houses as well. Though we in Denver are beyond the clearance sale in our housing market, home prices are on the rise giving sellers more leverage as well.

Enjoy the holidays, spend time with your loved ones, take a spin around town and take in the lights. Then call me when you’ve got the ornaments put away and we’ll get the ball rolling.

I live in Denver. The houses here can be pretty old. Beautiful Victorians, Denver Squares and Craftsman Bungalows line the graceful streets with their Dutch Elm trees and cracked sidewalks. As a real estate agent who specializes in the downtown Denver neighborhoods, I know these homes, some of them rather intimately. When my buyers are swept off their feet by a charming Congress Park home, the first thing I tell them before we write the offer is “Don’t get too excited until after the inspection.”

Regardless of the snappy remodel and those shiny granite counters, over 40% of previously owned homes on the market have at least one major defect. Even the ‘gently used’ newer homes, like the Mid-Century Modern homes in my Dream House Acres neighborhood most likely needs some repair or improvement, that’s to be expected. The trick is to find out what problems may be lurking up ahead and avoid them or know the price of the remedy. My suggestion for both buyers and sellers is to get an inspection.

There are many things you can do to gather information on your new home, depending on how deep you want to go and how much you want to spend. A home inspection and sewer scope are essential, though you can add radon and mold testing, meth lab testing, surveys, air & soil samples, you name it. No matter how far you go, there are sure to be some surprises, the trick is to uncover them first. Sellers can benefit from a pre-listing inspection in two ways. 1. Prepare yourself for issues that may concern your buyer and address them before going on the market. 2. For a quick sale, offer your buyer your inspection report along with the neighborhood comps and a price that reflects any pressing repairs. That way you can show the value and be firm on your price.

The most serious things to be on the lookout for are:

• Horizontal foundation cracks. Diagonal stress around window sills and thresholds is pretty normal in an old house, but the horizontal cracks require more information and perhaps the advice of a structural engineer.

• Major house settlement. Everything settles, but you shouldn’t feel like you’re at sea when you’re walking down the hallway. I see homes in Park Hill and the Highlands, as well as other Denver neighborhoods, with hardwood floors that slant or slope. Some of these houses are 100 years old, most of the settling has already occurred. If it feels wonky, have a good talk with your home inspector or ask for one who is a structural expert.

• Broken or cracked sewer line or tap. Always have the sewer line checked before you buy. Always. Even if you have to scope, pay for the roots to be cleaned out and re-scope, it’s worth it. You want to know the integrity of the line, its connections and what that line is made of. Sewer line issues are not always deal breakers, often times the seller (even the banks) will give you a credit for repairs. What you don’t want is for that puppy to break just as you put that last piece of Grandma’s china in the hutch.

• Defective roof or flashings. Putting on a new roof can be expensive and like a sewer line, it’s not too sexy. Cost varies as well, depending on the type of roof currently on the house and whether it can be repaired. If the roof is middle-aged with little or no damage, have your agent (that’d be me of course 😉 ask the seller for a five year certification.

• Cracked heater exchange or failing air-conditioning compressor. Here again, I always ask that the heating and air systems be cleaned and certified by a licensed HVAC technician.

1. Chimney settling or separation. You will want to know if your beautiful wood-burning fireplace is in good working condition or if it can be converted to gas. An inspection of the chimney is your first step, though I would strongly advise you have a chimney expert out to take a look before you light a fire.

• Moisture in the basement. Once again, not always a deal breaker but you want to know the cause and if it’s been fixed. Moisture is the leading cause of foundation problems and mold so follow the water.

• Mixed plumbing. Many times upgrades have been done over time in these old houses, mixing copper pipe with the original galvanized plumbing. Get an idea of what you’ve got and how much it would cost to convert all to copper either now or in the future.

• Aluminum wiring and an undersized electrical system. We use a lot more electricity now than in 1920 when the house was built. Look to see if the wiring is aluminum and how big the electrical panel is. Being under-energized can cause breakers to blow, lights to flicker and present a possible fire hazard. Now, I’ve sold plenty of homes with older wiring and less than state-of-the-art sub-panels but if you have any doubt, call an electrician.

• Infestation. Though termites and carpenter ants are not as common in Colorado as they are in other markets, they do exist here. During the winter, critters like squirrels, pigeons and raccoons can nest under decks and porches or in eaves and attics. Be on the alert for any potential access points so you’re not harboring refugees come springtime.

• Environmental hazards including underground plumes, radon, asbestos, and lead-based paint. Unless they’ve been abated, nearly all of these old houses have some lead based paint somewhere under those layers; radon and asbestos are also common. If the radon levels are in the acceptable range and the asbestos is contained, you may not ever have an issue and both can be mitigated. Many cities have underground plumes or areas where water has been shown to have a higher risk of contamination. You can find out by searching Google as most of this is in public record. . It is always a good idea to hire an environmental expert to assess any health risks or concerns you may have about the home.

Have I scared you right out of the contract? Not to worry. The big message here is to make sure you hire the experts. A certified home inspector will provide clearer and better information than your Uncle Louie, even though he knows his way around a house. Have your agent schedule your inspections as soon as you go under contract and make sure to be there along with your Realtor. You’ll want to ask a ton of questions and make sure you get a complete package of the inspection report.

Knowledge is your best protection against buying a home based more on emotions, rather than as a sound investment. Knowing what is up ahead brings peace of mind.

How would it affect you if you could no longer write off the interest you pay on your mortgage?

According to panelists at Friday’s housing forum hosted by Zillow and the University of Southern California’s Lusk Center for Real Estate:

The burgeoning federal debt makes it unlikely that the mortgage interest tax deduction will survive in its present form. Of course, any proposed changes to the tax break for homeowners will spark a fierce debate over the fundamentals of the U.S. housing market, the value of home ownership, and consumer behavior.

“Fierce debate” he says? I’d call it a jobs-killer! But then again, I’m in real estate. Change is never easy, but when it hits our pocketbooks and the government, it really hits home. I advise my clients to educate themselves, talk to their tax professional and view the tax benefits icing on the cake. Knowing the long-term financial upside leaves them feeling good and more secure as they move forward with their biggest single purchase.

“I think it’s entirely likely that something big is going to happen (with the MID) starting next year with either administration,” said Jason Gold, director and senior fellow at the Washington, D.C.-based Progressive Policy Institute, an independent think tank.

A Congressional contingent advocates for the elimination of the mortgage interest deduction to help address the nation’s debt and budget deficit. Obviously things must be done to right the problem, but sticking it to a Middle Class whose beginning to feel the effects of a post-crisis housing market recovery seems a bit harsh. At the end of this year, a series of tax increases and spending cuts are scheduled to go into effect automatically unless Congress acts to prevent or alter them. Revamping the mortgage interest deduction is on the table as a way to head off that “fiscal cliff” scenario. (I wonder how many of those guys have a mortgage.)

Two years ago, a bipartisan deficit reduction commission recommended scaling back the mortgage interest deduction, which is currently capped at mortgages worth up to $1 million for both principal and second homes and home equity debt up to $100,000 and the deduction is only for taxpayers who itemize.

The Simpson-Bowles commission proposed turning the deduction into a 12 percent non-refundable tax credit available to all taxpayers, capping eligibility to mortgages worth up to $500,000, and eliminating the deduction on interest from second homes and home equity debt.

Though that seems more reasonable to me than the first idea, the National Association of Realtors has consistently defended the mortgage interest deduction in its current form.

Highly critical of the recommendation and claiming any changes to the MID could depreciate home prices by up to 15 percent, they are promising to “remain vigilant in opposing any plan that modifies or excludes the deductibility of mortgage interest.”

So… we’re back to whose going to pay down the debt? And how.

The MID is a “tax expenditure,” meaning its cost must either be made up through higher taxes elsewhere or by adding to the debt, and it costs the government about $90 billion a year. Richard Green, the director of the USC Lusk Center for Real Estate, told forum attendees that reforming the MID is necessary for fiscal sustainability. “We need to get revenue,” Green said. “You need to make a judgment about what’s better or worse for the economy. In my opinion, it’s better to do it with tax expenditures, rather than rates, though you may have to do both to get to where we need to be.”

Because mortgage interest rates are currently so low, he added, “This may be an opportunity to do less damage by reforming the mortgage interest deduction than at other times.”

(I wonder what cuts would make this guy feel the pinch.)

The mortgage interest deduction is particularly polarizing because of the disconnect between how people use it and how it is perceived. Green gave the example of Texas where most people do not itemize their taxes (only about 30% of taxpayers do) so they cannot take advantage of the MID. This line of thought perplexes me. So… if more Texans itemized their taxes it would make things fairer? or does he mean that if they actually knew they could they would, adding to the deficit? And haven’t Texans done enough of that? 😉

No matter how the chad falls in the next three weeks, watch for ongoing and loud debates over the Mortgage Interest Deduction. *covers ears*

Source: Inman News, Andrea V. Brambila, Monday October 15, 2012