|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Year. New Opportunity!

What opportunities will you have to buy or sell a home this year? Don’t think you’ll have one? Think again!

Let’s start by looking waayyy back to December 2023, and then we’ll look forward. Aside from the seasonal slowdown, higher interest rates and low inventory, have had the most impact on the market. You can dive deeper by clicking the full Denver Real Estate Market Trends report, and know I’m always here for you with home values and neighborhood trends catered to your specific needs. Now, back to the future.

In my experience…

Winter is the best time to buy a home. Fewer buyers are willing to face the cold, postponing their shopping for early spring, giving you an opportunity to make an offer with less (or no) competition. And sellers who sell in the winter generally have good reason to. This means their motivation is driven by their needs rather than their wants. Another opportunity!

Waiting for the rates to fall? Don’t. While nobody knows for sure what will happen in 2024, we are anticipating multiple rate drops as the economy stabilizes, but the “waiters” often lose. Think about it. If you buy early, you’ll be gaining equity as prices rise with demand. Buyers who wait to time the market will face a different set of challenges. Lower rates bring more buyers, bidding wars and higher prices which increase the gains for those willing to buy now and refinance once all that rate dropping happens. Today’s rates from my lending partner, Select Lending Services, look a lot better overall than where we were last year.

Let’s talk about how 2024 can open a real estate opportunity for you!

I got the call that they were relocating to Denver from Indiana in a month, coming in for a long weekend to buy a house. I knew it was much more than finding a house, we needed to find them their home. “Power shopping” in 90 degree heat, we toured ten properties. With their wonderful parents and a great son in tow, these buyers were champs! At day’s end we went for tacos at North County and discussed the top contenders over delicious margaritas. The next day, loaded up with snacks and water, we set out to see another ten. End of the day, our last showing was in Castle Rock. And it was PERFECT! Our offer was accepted and yesterday our new Colorado residents (and my new friends) moved into their gorgeous home. Congratulations, Nick, Katie, and Jake!

The numbers are in and it’s been a wild ride! The year started with an insane first quarter, with buyers offering more than $100k over asking price, waiving inspections, covering appraisal gaps. And then, interest rates went up, showings dropped off, prices came down, and the market got… quiet.

It is common for the Denver real estate market to expect a seasonal slow down after July 4th, but this year’s cooling happened early. With the rise in inflation, the Feds pushed hard on rates and buyers pulled back. Many were exhausted by the Q1 rush, some felt the effects of the stock market, while others feared the increased interest rates. When rates rise 1 point, that’s a 10% reduction in buying power. A reduction in the loan amount often moves a buyer into a lower, more competitive, price point. Home prices have adjusted to these changes, leveling off a bit and shifting toward more balance, between home buyers and sellers.

“Every indicator points to the market shifting closer to a buyer’s market. The month-end active listing increased 21.53 percent last month, pending and closed deals decreased and days in the MLS increased by 30 percent. We are still a long way from what many experts would consider a buyer’s market.” -Andrew Abrams, DMAR Trends Committee Chair

With the number of residential homes on the rise, buyers have more options, but sellers see themselves with more competition than they did earlier in the year. The average close price saw a minor dip from the prior month but year over year, there was a 11.04% increase. As for days on market, there was both an increase from last month and from the same time in 2021.

With all the changes in the economy, we are not surprised to see movement in the real estate market too. However, don’t let the numbers keep you from your end goal. Whether that’s buying, selling, or investing one thing I know is that its your life that moves you, not the market. NOW is always the right time if it fits your personal situation.

Looking for more explanation on all of this? Comment, call/text/email and let’s have a conversation. Or if you’re shy like me, check out the Market Report for Q2 . If you want to see where we are today, click on the Denver Metro Association of Realtors Market Trends Report for August.

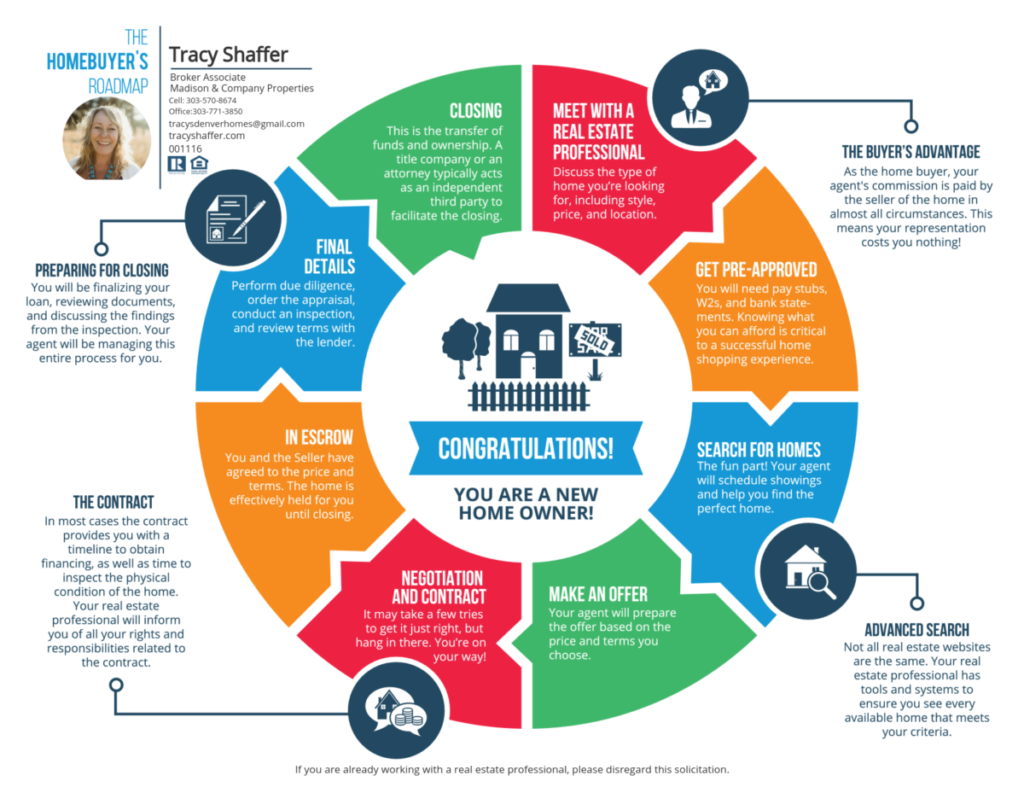

If you’re new to the home buying process, just starting to think about it, or haven’t done it in awhile, here’s help. Though there are many variables that exist within each transaction, these basic steps are the same. My job is to make sure it runs smoothly, from our first consultation to beyond the closing. Just like every home is unique, so is every home buyer. Knowing how much house you can afford is an important first step and getting pre-approved is critical. ( I work with some stellar lenders, I’d be happy to introduce you). Having an idea of the numbers makes your home shopping more efficient, and you’ll be ready to write an offer quickly. That’s a must in this competitive market.

There is no such thing as “the perfect house”. Finding one you can fall in love with takes market savvy, intuition and teamwork. I love the first meeting with buyers when they tell me what they want in a home and I follow up with questions about things they hadn’t though of. And I love the moment when we find the home and the whole energy changes. So cool.

Any questions? Want to talk? Is now a good time? I’d love to hear what moves you and help you have a stress-free home buying experience you will enjoy.

It’s March and home prices are rising annually, outpacing inflation. Real estate data group, CoreLogic recently released their January 2017 Home Price Index (HPI), showing prices increased 0.7 percent month-over-month and 6.9 percent year-over-year.“A combination of factors is driving momentum ahead of the curve,

says Dr. Frank Nothaft, chief economist of CoreLogic.

“With lean for-sale inventories and low rental vacancy rates, many markets have seen housing prices outpace inflation. Over the 12 months through January of this year, the CoreLogic Home Price Index recorded a 6.9 percent rise in home prices nationally and the CoreLogic Single-Family Rental Index was up 2.7 percent—both rising faster than inflation.”

Accounting for limited available inventory, CoreLogic’s HPI Forecast expects home prices to rise 0.1 percent month-over-month from January to February, and 4.8 percent year-over-year from January 2017 to January 2018.

“Home prices continue to climb across the nation, and the spring home-buying season is shaping up to be one of the strongest in recent memory. A potent mix of progressive economic recovery, demographics, tight housing stocks and continued low mortgage rates are expected to support this robust market outlook for the foreseeable future. We expect the CoreLogic [HPI] to rise 4.8 percent nationally over the next 12 months, buoyed by lack of supply and continued high demand”

adds Frank Martell, president and CEO of CoreLogic.

And according to Realtor.com, spring home-buying season got an early jump this year, indicating record-high home prices and record-low days on market for February. This is especially true for Denver where you’ll see in the chart that showings for February are up over this time last year. Time to move!

“Tracy is the best!! She sold our 1 bedroom condo in a Historic Register building in Capitol Hill in Denver. Unlike many realtors who are just looking to make a sale and move on to the next, Tracy really cares about her clients and their financial situation. She actually convinced us not to sell the first time we contacted her because the market was in the pits and our condo was worth less than 1/2 what we paid for it. By following her advice and waiting a few years, we ended up making money on the condo when it sold for OVER the asking price. She was incredibly patient with all of our concerns and questions, and knows more about the market than anyone. Also worth mentioning that we were out of state for the whole process, so she handled EVERYTHING; renovations, cleaning, staging, pricing, showing, you name it! She made this very stressful situation much less so, and we can’t imagine using anyone else.” – Keith Orell

“Tracy is the best!! She sold our 1 bedroom condo in a Historic Register building in Capitol Hill in Denver. Unlike many realtors who are just looking to make a sale and move on to the next, Tracy really cares about her clients and their financial situation. She actually convinced us not to sell the first time we contacted her because the market was in the pits and our condo was worth less than 1/2 what we paid for it. By following her advice and waiting a few years, we ended up making money on the condo when it sold for OVER the asking price. She was incredibly patient with all of our concerns and questions, and knows more about the market than anyone. Also worth mentioning that we were out of state for the whole process, so she handled EVERYTHING; renovations, cleaning, staging, pricing, showing, you name it! She made this very stressful situation much less so, and we can’t imagine using anyone else.” – Keith Orell

Wonder why your home didn’t sell in a weekend? Here’s a bit of info on the summer real estate market. If you take a look at the graph you’ll see that showing traffic in 2Q 2016 is down quite a bit from the First Quarter of the year. This is no surprise, it’s been the seasonal trend for the last four years. Coming off of a super-heated real estate market this spring, the usual summer “slowdown” feels more dramatic than a political convention. If you’re “lingering” on the market for a whopping two weeks remember that listings don’t always sell in a weekend and not all of them get twenty offers, especially those priced over $350,000. Summer in Denver is not only the real estate selling season, it’s vacation time too! With so much to do in our lovely state, we get up, get out and go more often and our stressed out home buyers need a break. Showings tend to pick up again after the Fourth of July for those looking to make a move and settle in before school starts in late August. That’s the conventional wisdom coming from an unconventional gal.

What I have seen year-after-year is a strong autumn season for real estate sales when the summer buyers have either completed or delayed their purchase and those who want to serve Thanksgiving in a new home come out to play. Same goes for the end of the year when myth tells us it’s a bad time to list a house for sale. My experience has been that winter buyers are fewer, yes, but they are more serious and with our continued lack of inventory many will see the cooler months as a less competitive time to purchase a home. Look for more soon in my next Real Estate Market Update.

Let’s talk about homeownership. Are you considering buying vs. renting?

Renters often ask me if it’s too late to buy a house: Are we heading for a big downturn? Are we too deep in the market cycle to buy? they wonder. Timing the real estate market perfectly is extremely difficult, perhaps impossible, and some of these potential buyers were the same renters that were sitting on the fence when the market was down, even once we’d passed the nadir. I believe that buying a home is less about the market and more about life; your life. So don’t try to time the market, take a look at your life, the low interest rates and time that!

1.) Are you getting married, starting a family, or tired of paying skyrocketing rent without having an asset to show for it? Would you like to have more space; a backyard for the dog, the kids, the BBQs, or the tomatoes? Do you like the idea of being part of a neighborhood, community? Perhaps you got a nice raise, job or promotion and you’d like to set down roots, do you plan on staying in one place for at least five years? Do you like the idea of investing in something that will build long-term wealth?

These are the types of questions you should be asking when you are considering homeownership.

Here’s another thing to keep in mind. In the U.S., the average total net worth of rental households is $5,800. Compare that with the average net worth of a home-owning household at $199,500 and you’ve got worth 34 times more than those who rent! There’s no doubt that over the long term, homeownership is a solid way to build wealth and financial security. I often advise my first-time buyers to get into something affordable now (not so easy in Denver these days, but doable) and then move up when life allows. If you can keep that first property as a rental, it’s a great way to invest in your financial future.

2. Interest rates remain at record lows but this can’t last forever. No one knows when they’re going to rise, but news this week gave hints of a rise as early as June. Though home prices have gone up the past several years, low interest rates continue to make homes relatively affordable— especially compared to renting. Once interest rates rise, the door to home affordability will begin to close for a lot of potential buyers, leaving them sorry they didn’t act when interest rates were at 50-year lows.

Let me break down the numbers. Assume you are purchasing a $210,000 condo with a 5 percent down payment. The Principle + Interest payment at 4% interest would be $952 per month (tax and insurance and HOA not included). An interest rate increase of one percent (5%) would take your payment of $1,070 per month—an increase of $1,416 a year. Now assume that rates tick up to 6 percent. That increase would result in a 21 percent increase in payments from $952 to $1,196. Where you really see the effect of these increases is when you hold the property for the full 30 years. On a $210,000, 30-year fixed-rate mortgage that increases from 4 to 5 percent, the borrower who obtains the 5 percent loan would pay an additional $42,772 in extra interest as opposed to the borrower who paid just 4 percent interest. Though most buyers consider their monthly payment as most important, when you look at the life of the loan you’re paying a lot more in the total loan amount. This is a great reason to make a “move-up” move right now. Say you’ve outgrown your place, it may be time to cash out and get your “forever home”, or like I mentioned, use your current home as an income property and let your renters pay off your mortgage.

The main reason the average home owner has so much more personal wealth than the average renter is that homes appreciate in value. Over the past 45 years, homes in metro Denver appreciated 6.3 percent per year. If you buy a $200,000 home, you can expect over the long term its value to rise about 6 percent every year. This means you’d make $12,000 in appreciation the first year, an additional $12,720 the second year, another $13,483 in the third year, and on and on. Contrary to popular belief, only 4 of the past 45 years did prices actually fall in metro Denver.

If you’re still wondering whether you’d be better off renting or buying, Trulia built a great Rent-vs-Buy tool. Answer a few simple questions and the system tells you whether it makes more financial sense over the next seven years to rent or purchase. I think it’s worth a couple minutes of your time to see what you can learn – you’ll really like it!

Key Messages for May

Prices are up 8% in the prior 12 months vs historical 6%. Inventories are tighter than last year, especially for small, lower priced homes. In 2016, we expect 8-9% appreciation, flat unit sales volume increases, and continued tight inventories.

This site uses cookies. By continuing to browse the site, you are agreeing to our use of cookies.

Accept settingsHide notification onlySettingsWe may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds: