I’m moving! Well actually, I am planning to move. Next year. That’s how long it will take me to prepare my current home as a rental, give the tenants in the other house notice, and most importantly, let my son finish eighth grade at his current school. The idea came to me this summer when my old friend/former neighbor/current client called to discuss her options regarding the inspection objection on her new home. “We’re sitting in the backyard having wine. I wish you were in the hood, you could come over.” And that’s when it hit me; I’m too far away from my friends! I’ve been rumbling a plan around in my head since then, but I knew it was in the cards when my thirteen year old jumped in the car one day and stated, “Mom, I don’t think these suburban kids are my people.” Oh, I feel ya, babe.

I’m moving! Well actually, I am planning to move. Next year. That’s how long it will take me to prepare my current home as a rental, give the tenants in the other house notice, and most importantly, let my son finish eighth grade at his current school. The idea came to me this summer when my old friend/former neighbor/current client called to discuss her options regarding the inspection objection on her new home. “We’re sitting in the backyard having wine. I wish you were in the hood, you could come over.” And that’s when it hit me; I’m too far away from my friends! I’ve been rumbling a plan around in my head since then, but I knew it was in the cards when my thirteen year old jumped in the car one day and stated, “Mom, I don’t think these suburban kids are my people.” Oh, I feel ya, babe.

Moving to Denver from Los Angeles, we settled in to Congress Park for the first ten years. The boys went to Denver Public schools and loved them. I loved the sense of community I felt; summers under the elm trees at the Congress Park pool, cool autumn evenings on the soccer fields, and all the school activities with the kids and parents I was growing up with. I felt safe, and I felt loved. People got my sense of humor, we shared our sorrows, our secrets and our extra tomatoes when the gardens were good. As our family’s needs and the market changed, we crept slowly southward. I kept the boys in Denver Public Schools as long as I could but the daily commute in the winter was fraying my sanity and my tread. I began to notice my urge for the urban as I kept putting buyers into my favorite neighborhoods; Park Hill, Congress Park, Washington and Platt Parks, Mayfair, (I could go on) but never realized it was all part of my secret plan. Now that Gabe has decided he wants to forgo the big suburban high school experience to attend East with his best friend and the other members of his “tribe”, I’m out of the walk-in closet and all in!

I grew up in the suburbs, have nothing against them in general or my neighborhood in particular. Actually I like it here in this funky little sweet spot called Dream House Acres. Free from the covenants and cul de sacs that make me claustrophobic, I love the wide, hilly streets, the mid-century modern houses and the mountain views from my back patio. I don’t even mind the 20 minute commute when I choose to make it; I’m just a city girl. I need the proximity to the arts and cultural centers, the theaters, restaurants and farmers markets that pop up spring through fall. Most of all, I need to be around a wide variety of people and the sense of community that Denver offers.

Why do I bring this up, you ask? As a real estate agent, I spend my days and into the nights helping movers and shakers change up their lives. While I’m focused on the business of buying and selling homes that make these moves worthwhile, my clients are focused on the mental, emotional, physical and financial planning that leads up to a big change in your habitat. Following a page out of my own playbook, I’ve pulled out the Task Timeline Template which I lovingly bestow upon my clients.

I have completed phase one; Making The Decision. Phase two, Preparing the House, will take much longer; pulling up carpet, throwin’ down a little love on the hardwood floors, the painting, slight upgrades to the kitchen and baths…slight? Who am I kidding? And along the way,I will partake in my favorite slice of Virgo heaven— PURGING! When you think about it, there is no way to move without making a decision about every single thing you own. What stays, what goes, how many sets of socket wrenches do I really need, will I really wear this? Thank god I have a year.

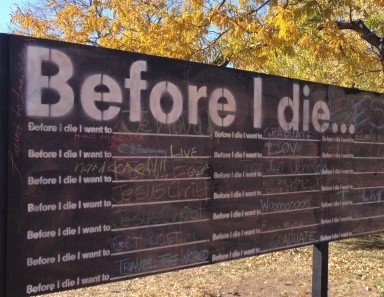

Taking the time to wrap up the dishes and the memories this house holds, I will be mindful to keep the valuables and leave the rest behind. A fresh coat of paint, like a white sheet of paper, lets the new occupants write their own stories on these walls (not in the literal sense, I hope), as I move forward to the next chapter of life. Painting the new place.

If you’re ruminating on such things~ buying or selling, up or downsizing, Spanish Olive vs. Navajo White~ give me a call. We can share tips as we scrub grout and fantasize about the new digs. After all…I’m improving my skills just for you.