Wonder why your home didn’t sell in a weekend? Here’s a bit of info on the summer real estate market. If you take a look at the graph you’ll see that showing traffic in 2Q 2016 is down quite a bit from the First Quarter of the year. This is no surprise, it’s been the seasonal trend for the last four years. Coming off of a super-heated real estate market this spring, the usual summer “slowdown” feels more dramatic than a political convention. If you’re “lingering” on the market for a whopping two weeks remember that listings don’t always sell in a weekend and not all of them get twenty offers, especially those priced over $350,000. Summer in Denver is not only the real estate selling season, it’s vacation time too! With so much to do in our lovely state, we get up, get out and go more often and our stressed out home buyers need a break. Showings tend to pick up again after the Fourth of July for those looking to make a move and settle in before school starts in late August. That’s the conventional wisdom coming from an unconventional gal.

What I have seen year-after-year is a strong autumn season for real estate sales when the summer buyers have either completed or delayed their purchase and those who want to serve Thanksgiving in a new home come out to play. Same goes for the end of the year when myth tells us it’s a bad time to list a house for sale. My experience has been that winter buyers are fewer, yes, but they are more serious and with our continued lack of inventory many will see the cooler months as a less competitive time to purchase a home. Look for more soon in my next Real Estate Market Update.

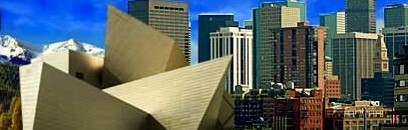

Denver Real Estate News May 2015

What’s new in the Denver Real Estate Market?

The question I’m asked all the time by friends, colleagues and clients who are still renting is whether it’s too late to buy a home. “Are we heading for a big downturn?” and “Are we too deep in the market cycle to buy?” they wonder. For those of you who read my newsletter and know me well the following will sound familiar but it bears repeating: timing the real estate market perfectly is extremely difficult (maybe even impossible) and those who try usually fail. So don’t try to time the market. Instead, look at factors like the ones below to see if homeownership is right for you.

1. You should buy a home when you feel it’s the right time in your life to do so. Don’t try to time the market, instead time your life. Are you getting married? Sick of paying skyrocketing rents? Looking for a bigger place for you and your family? Want your own backyard for the kids to play in? Want to be part of a neighborhood community? Plan on staying in one place for a number of years? Want to build long-term wealth? These are the types of questions you should ask yourself when considering whether you want to own a home. To the extent you say yes, home ownership might be the answer for you.

One important stat to keep in mind is that the average rental household in the U.S. has a total net worth of only $5,500. In contrast, the average homeowner has a net worth of $195,500 — that’s 36 times those who rent! Over the past 15 years, this multiple has ranged from as low as 31 times to as high as 46 times the net worth of renters. You don’t want to try to time the market, but over the long term home ownership is the tried and true path to wealth accumulation and financial security. (So is owning rental property, by the way. Call me if you’d like to learn more about that as well.)

2. Interest rates remain at record lows but this can’t last forever. No one knows when they’re going to rise (remember, you can’t time the market!), but rise they will at some point in the future. Though home prices have gone up the past several years, low interest rates continue to make homes relatively affordable (especially compared to renting). Once interest rates do rise the window of home ownership affordability will truly begin to close for a lot of potential buyers and they will be sorry they didn’t act when interest rates were at 50-year lows.

To illustrate the numbers, assume you are purchasing a $210,000 home with a 5 percent down payment. The Principle + Interest payment at 4 percent interest would be $952 per month. Just a 1 percent interest rate increase to 5 percent would result in a payment of $1,070 per month for a total increase of $128/month and $1,416/year. Now assume that rates tick up to 6 percent. That increase would result in a 21 percent increase in payments from $952 to $1,196. Where you really see the effect of these increases is when you hold the property for the full 30 years. On a $200,000, 30-year fixed-rate mortgage that increases from 4-5 percent, the borrower who obtains the 5 percent loan would pay an additional $42,772 in extra interest as opposed to the borrower who paid just 4 percent interest. That’s 21.4 percent of the total loan amount! This is why a lot of folks who don’t purchase a home while interest rates are near record lows are going to regret it down the road.

3. The main reason the average home owner has so much more personal wealth than the average condo owner is that over time, homes appreciate in value. Over the past 44 years, homes in metro Denver appreciated 6 percent per year, about 1 percent above the inflation rate. If you buy a $200,000 home, you can expect over the long term its value to rise about 6 percent every year. This means you’d make $12,000 in appreciation the first year, an additional $12,720 the second year, another $13,483 in the third year, and on and on. It’s that simple. So if you want to build wealth, your best bet may be to take advantage of these numbers and buy a home for the long term. I can help you do this. Call me and let me show you how.

Denver Home Prices Rise Again

According to the latest monthly Case-Shiller Home Price Index, Denver-area home-resale prices rose an average 9.1 percent in March from a year earlier. Prices were up 1.4 percent from February, reaching an all-time high. One reason for this, as you may well know, is that our inventory is still incredibly low. Last spring, when the market suddenly turned, we thought this was a fluke but a year out, this seems to be the new norm. Click here to read more in the Denver Business Journal.

What does this mean for you? SELL! I have clients who made a move up during the leaner years and if they were able to hold on to their first property and buy their second, that’s what I’ve encouraged them to do. Rental income and market appreciation made this a wise move for many and now that equity is allowing them to sell at a tidy profit. I’m all for real estate investing and for having a buy and hold strategy in your portfolio, but you need to ask yourself if that is the best use of your money right now. Sometimes an investment has peaked and/or life has changed drastically, providing other options or shall we say ‘rearranging priorities’?

Buyers and sellers are often hesitant to sell for fear of finding a replacement home and though the market is swift like a snowmelt stream, I’ve yet to move one of my clients into a hotel or a shelter. All things are negotiable.

So if you’re looking, or thinking about looking., selling or wondering if selling is your best option, I’d love to sit down and have a conversation with you.

It’s “Cruiseship Limbo Contest” winning low. It’s Barry White “Can’t Get Enough of Your Love” low. It’s “Bring out the charts and graphs!” kinda low. When you look at the housing market, it’s all relative. “Fewer people buying houses with a lot more people having to sell them”, that’s the kind of market we got used to after the shock of the bubble burst wore off. Then there was a stasis where the flood of foreclosures had receded and there was a nice level of inventory, but buyers wary of further market drop stayed on the fence: 2011 in a nutshell. Last January the shift began and like a flash flood, buyers filled the streets. Now we have lots of buyers and where are the sellers? Denver housing market inventory is at a 23 year low. What does that mean for you? Buyers should buy now, sellers should list while they have no competition, and you should call me with any questions you have about either.

Winter Home Buying? You bet your ice skates!

After you’ve finished your holiday shopping, why don’t we go look for a house?

Winter home buying has its challenges, but winter can be the perfect time to buy a home. As we head toward the snowy months, serious shoppers know their winter home buying power is increased by determination and AWD. Housing market prediction for 2014 is looking good and buying a home this winter might just be the ultimate stocking stuffer.I love me those cold weather clients!

Most people think of buying or selling their homes in the ‘high’ season, and while the balmy days of spring and summer are perfect for cruising open houses and power shopping, they also bring the crowds. In 2013 we saw a big bump in the Denver housing market:lots of buyer activity and low inventory meant happy sellers and buyers who were frustrated by the return of the multiple offer. Even when the market was down the notion that summer is the best time to buy/sell your house is one that is hard to break. After spring break, sellers prepare to list the moment the last school bell rings pushing inventory up and in the seller’s minds prices too. Many of these listings are sellers who want to test the waters, plant a For Sale sign in their yard along with the annuals and see if they get the price they want. But this supply side increase often works in the buyers’ favor or frustrates them when the fair-weather seller lacks the motivation to agree on a fair price. Sellers feel the same when sunny day buyers, indulging in some fantasy house hunting, create lots of traffic and little else.

Cold weather buyers and sellers are serious.

The real estate market is driven by many factors but the first and most enduring one is CHANGE. One of the most enduring reasons people buy or sell a home is because their lives are in transition. Though many plan their home sale or purchase, life happens without regard to season or convenience. Families change, jobs are gained, lost or relocated, promotions happen, marriage, divorce, birth and death– all create someone with a housing need.

Shopping or selling in a Denver winter are obvious– driving in show, slipping on ice, shoveling the walkway, taking your boots on and off so you don’t track sludge into the house, fewer showings– but the buyers are BUYERS and not just lookers. Winter sellers are ready and willing to make a move, and tend to price accordingly from the start. The slower season also means that lenders, title companies and appraisers are not so swamped, smoothing out the process and lowering emotion. And of course, there are fewer people submitting offers on your dream home.

As savvy shoppers know, the post-holiday season comes with plenty of opportunities for a bargain and that includes houses as well. Though we in Denver are beyond the clearance sale in our housing market, home prices are on the rise giving sellers more leverage as well.

Enjoy the holidays, spend time with your loved ones, take a spin around town and take in the lights. Then call me when you’ve got the ornaments put away and we’ll get the ball rolling.

I live in Denver. The houses here can be pretty old. Beautiful Victorians, Denver Squares and Craftsman Bungalows line the graceful streets with their Dutch Elm trees and cracked sidewalks. As a real estate agent who specializes in the downtown Denver neighborhoods, I know these homes, some of them rather intimately. When my buyers are swept off their feet by a charming Congress Park home, the first thing I tell them before we write the offer is “Don’t get too excited until after the inspection.”

Regardless of the snappy remodel and those shiny granite counters, over 40% of previously owned homes on the market have at least one major defect. Even the ‘gently used’ newer homes, like the Mid-Century Modern homes in my Dream House Acres neighborhood most likely needs some repair or improvement, that’s to be expected. The trick is to find out what problems may be lurking up ahead and avoid them or know the price of the remedy. My suggestion for both buyers and sellers is to get an inspection.

There are many things you can do to gather information on your new home, depending on how deep you want to go and how much you want to spend. A home inspection and sewer scope are essential, though you can add radon and mold testing, meth lab testing, surveys, air & soil samples, you name it. No matter how far you go, there are sure to be some surprises, the trick is to uncover them first. Sellers can benefit from a pre-listing inspection in two ways. 1. Prepare yourself for issues that may concern your buyer and address them before going on the market. 2. For a quick sale, offer your buyer your inspection report along with the neighborhood comps and a price that reflects any pressing repairs. That way you can show the value and be firm on your price.

The most serious things to be on the lookout for are:

• Horizontal foundation cracks. Diagonal stress around window sills and thresholds is pretty normal in an old house, but the horizontal cracks require more information and perhaps the advice of a structural engineer.

• Major house settlement. Everything settles, but you shouldn’t feel like you’re at sea when you’re walking down the hallway. I see homes in Park Hill and the Highlands, as well as other Denver neighborhoods, with hardwood floors that slant or slope. Some of these houses are 100 years old, most of the settling has already occurred. If it feels wonky, have a good talk with your home inspector or ask for one who is a structural expert.

• Broken or cracked sewer line or tap. Always have the sewer line checked before you buy. Always. Even if you have to scope, pay for the roots to be cleaned out and re-scope, it’s worth it. You want to know the integrity of the line, its connections and what that line is made of. Sewer line issues are not always deal breakers, often times the seller (even the banks) will give you a credit for repairs. What you don’t want is for that puppy to break just as you put that last piece of Grandma’s china in the hutch.

• Defective roof or flashings. Putting on a new roof can be expensive and like a sewer line, it’s not too sexy. Cost varies as well, depending on the type of roof currently on the house and whether it can be repaired. If the roof is middle-aged with little or no damage, have your agent (that’d be me of course 😉 ask the seller for a five year certification.

• Cracked heater exchange or failing air-conditioning compressor. Here again, I always ask that the heating and air systems be cleaned and certified by a licensed HVAC technician.

1. Chimney settling or separation. You will want to know if your beautiful wood-burning fireplace is in good working condition or if it can be converted to gas. An inspection of the chimney is your first step, though I would strongly advise you have a chimney expert out to take a look before you light a fire.

• Moisture in the basement. Once again, not always a deal breaker but you want to know the cause and if it’s been fixed. Moisture is the leading cause of foundation problems and mold so follow the water.

• Mixed plumbing. Many times upgrades have been done over time in these old houses, mixing copper pipe with the original galvanized plumbing. Get an idea of what you’ve got and how much it would cost to convert all to copper either now or in the future.

• Aluminum wiring and an undersized electrical system. We use a lot more electricity now than in 1920 when the house was built. Look to see if the wiring is aluminum and how big the electrical panel is. Being under-energized can cause breakers to blow, lights to flicker and present a possible fire hazard. Now, I’ve sold plenty of homes with older wiring and less than state-of-the-art sub-panels but if you have any doubt, call an electrician.

• Infestation. Though termites and carpenter ants are not as common in Colorado as they are in other markets, they do exist here. During the winter, critters like squirrels, pigeons and raccoons can nest under decks and porches or in eaves and attics. Be on the alert for any potential access points so you’re not harboring refugees come springtime.

• Environmental hazards including underground plumes, radon, asbestos, and lead-based paint. Unless they’ve been abated, nearly all of these old houses have some lead based paint somewhere under those layers; radon and asbestos are also common. If the radon levels are in the acceptable range and the asbestos is contained, you may not ever have an issue and both can be mitigated. Many cities have underground plumes or areas where water has been shown to have a higher risk of contamination. You can find out by searching Google as most of this is in public record. . It is always a good idea to hire an environmental expert to assess any health risks or concerns you may have about the home.

Have I scared you right out of the contract? Not to worry. The big message here is to make sure you hire the experts. A certified home inspector will provide clearer and better information than your Uncle Louie, even though he knows his way around a house. Have your agent schedule your inspections as soon as you go under contract and make sure to be there along with your Realtor. You’ll want to ask a ton of questions and make sure you get a complete package of the inspection report.

Knowledge is your best protection against buying a home based more on emotions, rather than as a sound investment. Knowing what is up ahead brings peace of mind.

How would it affect you if you could no longer write off the interest you pay on your mortgage?

According to panelists at Friday’s housing forum hosted by Zillow and the University of Southern California’s Lusk Center for Real Estate:

The burgeoning federal debt makes it unlikely that the mortgage interest tax deduction will survive in its present form. Of course, any proposed changes to the tax break for homeowners will spark a fierce debate over the fundamentals of the U.S. housing market, the value of home ownership, and consumer behavior.

“Fierce debate” he says? I’d call it a jobs-killer! But then again, I’m in real estate. Change is never easy, but when it hits our pocketbooks and the government, it really hits home. I advise my clients to educate themselves, talk to their tax professional and view the tax benefits icing on the cake. Knowing the long-term financial upside leaves them feeling good and more secure as they move forward with their biggest single purchase.

“I think it’s entirely likely that something big is going to happen (with the MID) starting next year with either administration,” said Jason Gold, director and senior fellow at the Washington, D.C.-based Progressive Policy Institute, an independent think tank.

A Congressional contingent advocates for the elimination of the mortgage interest deduction to help address the nation’s debt and budget deficit. Obviously things must be done to right the problem, but sticking it to a Middle Class whose beginning to feel the effects of a post-crisis housing market recovery seems a bit harsh. At the end of this year, a series of tax increases and spending cuts are scheduled to go into effect automatically unless Congress acts to prevent or alter them. Revamping the mortgage interest deduction is on the table as a way to head off that “fiscal cliff” scenario. (I wonder how many of those guys have a mortgage.)

Two years ago, a bipartisan deficit reduction commission recommended scaling back the mortgage interest deduction, which is currently capped at mortgages worth up to $1 million for both principal and second homes and home equity debt up to $100,000 and the deduction is only for taxpayers who itemize.

The Simpson-Bowles commission proposed turning the deduction into a 12 percent non-refundable tax credit available to all taxpayers, capping eligibility to mortgages worth up to $500,000, and eliminating the deduction on interest from second homes and home equity debt.

Though that seems more reasonable to me than the first idea, the National Association of Realtors has consistently defended the mortgage interest deduction in its current form.

Highly critical of the recommendation and claiming any changes to the MID could depreciate home prices by up to 15 percent, they are promising to “remain vigilant in opposing any plan that modifies or excludes the deductibility of mortgage interest.”

So… we’re back to whose going to pay down the debt? And how.

The MID is a “tax expenditure,” meaning its cost must either be made up through higher taxes elsewhere or by adding to the debt, and it costs the government about $90 billion a year. Richard Green, the director of the USC Lusk Center for Real Estate, told forum attendees that reforming the MID is necessary for fiscal sustainability. “We need to get revenue,” Green said. “You need to make a judgment about what’s better or worse for the economy. In my opinion, it’s better to do it with tax expenditures, rather than rates, though you may have to do both to get to where we need to be.”

Because mortgage interest rates are currently so low, he added, “This may be an opportunity to do less damage by reforming the mortgage interest deduction than at other times.”

(I wonder what cuts would make this guy feel the pinch.)

The mortgage interest deduction is particularly polarizing because of the disconnect between how people use it and how it is perceived. Green gave the example of Texas where most people do not itemize their taxes (only about 30% of taxpayers do) so they cannot take advantage of the MID. This line of thought perplexes me. So… if more Texans itemized their taxes it would make things fairer? or does he mean that if they actually knew they could they would, adding to the deficit? And haven’t Texans done enough of that? 😉

No matter how the chad falls in the next three weeks, watch for ongoing and loud debates over the Mortgage Interest Deduction. *covers ears*

Source: Inman News, Andrea V. Brambila, Monday October 15, 2012

UPDATE: This house went under contract in 8 days. Buyers are happy, sellers are happy… agent is very happy.

Just listed a wonderful 3 bed/3 bath home in the Willow Trace subdivision of Aurora South. I really like the floor plan as it lives large. The master bedroom is huge, closets are bigger than my house ; ) and the second/third bedrooms are nice and roomy. Great loft space upstairs to keep the little ones close or use for study/gaming area. Over-sized two car garage with secure storage. Partial basement is insulated, plumbed and egressed; ready for your finish if you need more space and Cherry Creek Schools! This house is totally move in ready! Check out the virtual tour.

![2Q16 Showing Traffic - TShaffer [4151395]-page-001 (1)](http://tracyshaffer.com/wp-content/uploads/2016/07/2Q16-Showing-Traffic-TShaffer-4151395-page-001-1.jpg)